Kodak 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

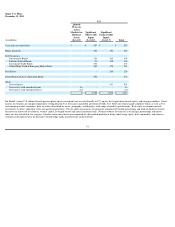

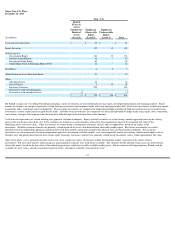

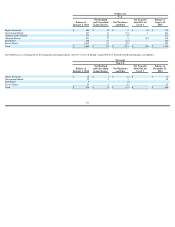

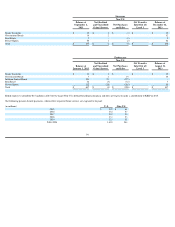

NOTE 19: STOCK-BASED COMPENSATION

2013 Omnibus Incentive Plan

Kodak’s stock incentive plan consists of the 2013 Omnibus Incentive Plan (the “2013 Plan”) which replaces all prior stock-based employee benefit plans (including the

2005 Omnibus Long-Term Compensation Plan and the 2000 Omnibus Long-Term Compensation Plan). The 2013 Plan is administered by the Executive Compensation

Committee of the Board of Directors, and the Board of Directors also has the authority and responsibility granted to the Executive Compensation Committee with respect

to the 2013 Plan.

Awards under the 2013 Plan may be cash-based or stock-based. Officers, directors and employees of the Company and its consolidated subsidiaries are eligible to receive

awards. Stock options are generally non-qualified, are at exercise prices not less than 100% of the per share fair market value on the date of grant and expire seven years

after the grant date. Stock-based compensation awards granted under Kodak’s stock incentive plan are generally subject to a three-year vesting period from the date of

grant. Unless sooner terminated by the Executive Compensation Committee, no awards may be granted under the 2013 Plan after the tenth anniversary of the Effective

Date.

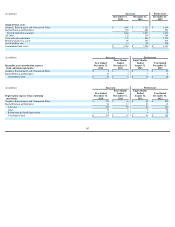

The maximum number of shares of common stock that may be issued under the 2013 Plan is approximately 4.8 million. In addition, under the 2013 Plan, the maximum

number of shares available for the grant of incentive stock options is 2.0 million shares. The maximum number of shares as to which stock options or stock appreciation rights

may be granted to any one person under the 2013 Plan in any calendar year is 2.0 million shares. The maximum number of performance-

based compensation awards that may

be granted to any one employee under the 2013 Plan in any calendar year is 1.0 million shares or, in the event such award is paid in cash, $2.5 million. The maximum number

of awards that may be granted to any non-

employee director under the 2013 Plan in any calendar year may not exceed a number of awards with a grant date fair value of

$900,000, computed as of the grant date.

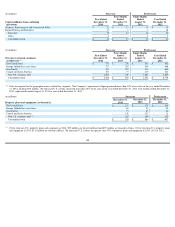

Compensation expense is recognized on a straight-line basis over the service or performance period for each separately vesting tranche of the award and is adjusted for

actual forfeitures before vesting. Kodak assesses the likelihood that performance-based shares will be earned based on the probability of meeting the performance

criteria. For those performance-based awards that are deemed probable of achievement, expense is recorded, and for those awards that are deemed not probable of

achievement, no expense is recorded. Kodak assesses the probability of achievement each quarter.

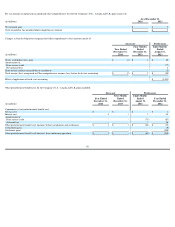

For the year ended December 31, 2014, compensation expense related to unvested stock awards was $8 million, of which $7 million was associated with unvested

restricted stock unit awards and $1 million was associated with unvested stock options. Compensation expense for the four months ended December 31, 2013 of $1

million was related to unvested restricted awards as Kodak did not issue any stock option awards during that period.

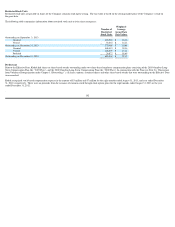

As of December 31, 2014 there was $9 million of total unrecognized compensation cost related to unvested restricted stock unit awards and $5 million of total

unrecognized compensation cost related to unvested stock option awards. The unrecognized compensation cost related to unvested restricted stock unit awards is

expected to be recognized over a weighted-average period of 1.7 years. The unrecognized compensation cost related to unvested stock option awards is expected to be

recognized over a weighted-average period of 1.8 years.

101