Kodak 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

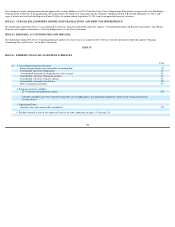

(25)

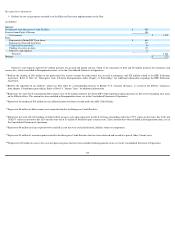

This adjustment eliminated the Predecessor goodwill balance of $56 million and records Successor goodwill of $88 million, which represents the reorganizational

value of assets in excess of amounts allocated to identified tangible and intangible assets, as follows:

Refer to Note 5, “Goodwill and Other Intangible Assets” for Successor goodwill by reportable segment.

Successor

(in millions)

As of

September 1,

2013

Reorganization value of Successor assets

$

3,463

Less: Fair value of Successor assets (excluding goodwill)

3,375

Reorganization value of Successor assets in excess of fair value - Successor goodwill

$

88

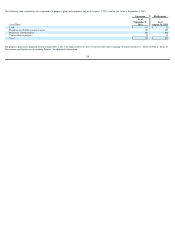

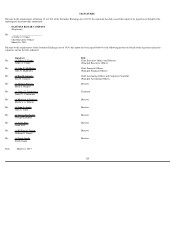

(26)

The net adjustment of $192 million reflects the write-

off of existing intangibles of $43 million and an adjustment of $235 million to record the fair value of intangibles,

determined as follows:

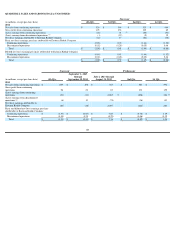

a.

Trade names of $54 million were valued using the income approach, specifically the relief from royalty method based on the following significant assumptions:

i. Forecasted revenues attributable to the trade names ranging from September 1, 2013 to December 31, 2023, including a terminal year with growth rates

ranging from 0% to 3%;

ii.

Royalty rates ranging from .5% to 1% of expected net sales determined with regard to comparable market transactions and profitability analysis;

iii.

Discount rates ranging from 27% to 32%, which were based on the after

-

tax weighted

-

average cost of capital; and

iv.

Kodak anticipates using its trade name for an indefinite period.

b. Technology based intangibles of $131 million were valued using the income approach, specifically the relief from royalty method based on the following

significant assumptions:

i.

Forecasted revenues attributable to the respective technologies for the period ranging from September 1, 2013 to December 31, 2025;

ii.

Royalty rates ranging from 1% to 16% determined with regard to comparable market transactions and cash flows of the respective technologies;

iii.

Discount rates ranging from 29% to 34%, based on the after

-

tax weighted

-

average cost of capital; and

iv.

Economic lives ranging from 4 to 12 years.

c. Customer related intangibles of $39 million were valued using the income approach, specifically the multi-period excess earnings approach based on the

following significant assumptions:

i.

Forecasted revenues and profit margins attributable to the current customer base for the period ranging from September 1, 2013 to December 31, 2024;

ii.

Attrition rates ranging from 2.5% to 20%;

iii.

Discount rates ranging from 29% to 38%, based on the after

-

tax weighted

-

average cost of capital; and

iv.

Economic lives ranging from 3 to 10 years.

d. In-process research and development of $9 million was determined using the income approach, specifically the multi-period excess earnings method based on the

following significant assumptions:

i.

Forecasted revenues attributable to the respective research and development projects for the period of September 1, 2013 to December 31, 2019;

ii.

Discount rate of 40% based on the after

-

tax weighted

-

average cost of capital adjusted for perceived risks inherent in the individual assets; and

iii.

Economic life of 6 years.

e. In addition, the Company recorded the fair value of other intangibles of $2 million primarily related to favorable contracts and leasehold improvements that were

favorable relative to available market terms.

119