Kodak 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

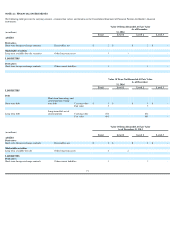

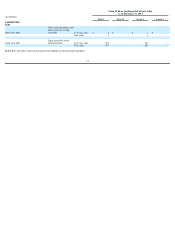

The following table provides asset retirement obligation activity:

Other Commitments and Contingencies

The Company and its subsidiaries have entered into operating leases for various real estate and equipment needs. Rental expense, net of minor sublease income,

amounted to $38 million, $15 million, $36 million and $60 million in the year ended December 31, 2014, four months ending December 31, 2013, eight months ending

August 31, 2013 and year ended December 31, 2012, respectively.

As of December 31, 2014, the Company had outstanding letters of credit of $123 million issued under the ABL Credit Agreement as well as bank guarantees and letters

of credit of $5 million, surety bonds in the amount of $19 million, and restricted cash and deposits of $50 million, primarily to ensure the payment of possible casualty

and workers’ compensation claims, environmental liabilities, legal contingencies, rental payments, and to support various customs, hedging, tax and trade activities. The

restricted cash and deposits are recorded in Restricted cash, Other current assets and Other long-term assets in the Consolidated Statement of Financial Position.

Kodak’s Brazilian operations are involved in various litigation matters and have received or been the subject of numerous governmental assessments related to indirect and

other taxes in various stages of litigation, as well as civil litigation and disputes associated with former employees and contract labor. The tax matters, which comprise the

majority of the litigation matters, are primarily related to federal and state value-added taxes. Kodak is disputing these matters and intends to vigorously defend its

position. Based on the opinion of legal counsel and current reserves already recorded for those matters deemed probable of loss, management does not believe that the

ultimate resolution of these matters will materially impact Kodak’

s results of operations or financial position. Kodak routinely assesses all these matters as to the probability of

ultimately incurring a liability in its Brazilian operations and records its best estimate of the ultimate loss in situations where it assesses the likelihood of loss as probable. As

of December 31, 2014, the unreserved portion of these contingencies, inclusive of any related interest and penalties, for which there was at least a reasonable possibility that a

loss may be incurred, amounted to approximately $50 million.

In connection with assessments in Brazil, local regulations may require Kodak to post security for a portion of the amounts in dispute. As of December 31, 2014, Kodak has

posted security composed of $8 million of pledged cash reported within Restricted cash in the Consolidated Statement of Financial Position and liens on certain Brazilian

assets with a net book value of approximately $90 million. Generally, any encumbrances on the Brazilian assets would be removed to the extent the matter is resolved in

Kodak's favor.

Kodak is involved in various lawsuits, claims, investigations, remediation and proceedings, including commercial, customs, employment, environmental, and health and safety

matters, which are being handled and defended in the ordinary course of business. Kodak is also subject, from time to time, to various assertions, claims, proceedings and

requests for indemnification concerning intellectual property, including patent infringement suits involving technologies that are incorporated in a broad spectrum of Kodak’s

products. These matters are in various stages of investigation and litigation, and are being vigorously defended. Based on information currently available Kodak does not

believe that it is probable that the outcomes in any of these matters, individually or collectively, will have a material adverse effect on its financial condition or results of

operations. Litigation is inherently unpredictable, and judgments could be rendered or settlements entered that could adversely affect Kodak’s operating results or cash flows

in a particular period. Kodak routinely assesses all of its litigation and threatened litigation as to the probability of ultimately incurring a liability, and records its best estimate

of the ultimate loss in situations where it assesses the likelihood of loss as probable.

Successor

Predecessor

(in millions)

For the Year

Ended

December 31,

2014

For the Four

Months Ended

December 31,

2013

For the Eight

Months Ended

August 31,

2013

Asset Retirement Obligations at start of period

$

52

$

51

$

63

Liabilities incurred in the current period

3

-

1

Liabilities settled in the current period

(1

)

-

(5

)

Accretion expense

2

1

1

Revision in estimated cash flows

(2

)

-

(1

)

Foreign exchange impact

(1

)

-

(1

)

Impact of fresh start accounting

-

-

(7

)

Asset Retirement Obligations at end of period

$

53

$

52

$

51

68