Kodak 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

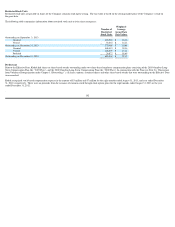

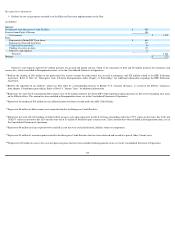

Registration Rights Agreement

On the Effective Date, the Company and the Backstop Parties executed a registration rights agreement (the “Registration Rights Agreement”). The Registration Rights

Agreement, among other rights, provides the Backstop Parties with certain registration rights with respect to the common stock.

Stockholders holding registrable securities representing 25% of the outstanding common stock as of the Effective Date may require the Company to facilitate a registered

offering of registrable securities; provided that if such registration has not been consummated prior to the second anniversary of the Effective Date, stockholders holding

registrable securities representing 10% of the outstanding common stock as of the Effective Date may require the Company to facilitate such an offering (such offering, the

“Initial Registration”). The registrable securities requested to be sold in the Initial Registration must have an aggregate market value of at least $75 million.

Following the Initial Registration, stockholders holding 10% or more of the outstanding registrable securities may demand that the Company file a shelf registration statement

and effectuate one or more takedowns off of such shelf, or, if a shelf is not available, effectuate one or more stand-alone registered offerings, provided that such non-shelf

registered offerings or shelf takedowns may not be requested more than four times and, in each case, shall include shares having an aggregate market value of at least $75

million. Beginning on the second anniversary of the Effective Date, upon request of a stockholder, the Company shall amend its existing shelf registration statement to register

additional registrable securities as set forth in the Registration Rights Agreement. Stockholders also have the right to include their registrable securities in the Initial

Registration or any other non-shelf registered offering or shelf takedown of the common stock by the Company for its own account or for the account of any holders of

common stock.

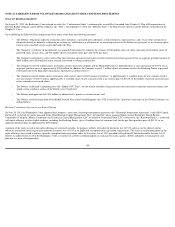

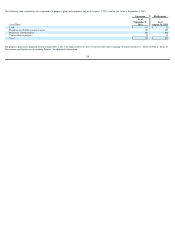

KPP Global Settlement

The Company had previously issued (pre-petition) a guarantee to Kodak Limited (the “Subsidiary”) and KPP Trustees Limited (“KPP” or the “Trustee”), as trustee for the

U.K. Pension Plan. Under that arrangement, EKC guaranteed to the Subsidiary and the Trustee the ability of the Subsidiary, only to the extent it became necessary to do so, to

(1) make contributions to the U.K. Pension Plan to ensure sufficient assets existed to make plan benefit payments, as they became due, if the Subsidiary otherwise would not

have sufficient assets and (2) make contributions to the U.K. Pension Plan such that it would achieve fully funded status by the funding valuation for the period ending

December 31, 2022.

The Subsidiary agreed to make certain contributions to the U.K. Pension Plan as determined by a funding plan agreed to by the Trustee. The Subsidiary did not pay the annual

contributions due by the funding plan for 2012 or 2013. The Trustee asserted an unsecured claim against the Company of approximately $2.8 billion under the guarantee. The

Subsidiary also asserted an unsecured claim under the guarantee for an unliquidated amount. The Trustee also asserted an unliquidated claim against all Debtors, as financial

support direction and contribution notice claims.

On April 26, 2013, Eastman Kodak Company, the Trustee, Kodak Limited and certain other Kodak entities entered into a global settlement agreement (the “Global

Settlement”) that resolved all liabilities of Kodak with respect to the U.K. Pension Plan. The Global Settlement also provided for the acquisition by KPP and/or its subsidiaries

of certain assets, and the assumption by KPP and/or its subsidiaries of certain liabilities of Kodak’s Personalized Imaging and Document Imaging businesses (together the

“Business”) under a Stock and Asset Purchase Agreement dated April 26, 2013 (the “SAPA”). The underfunded position of the U.K. Pension Plan of approximately $1.5

billion was included in Liabilities held for sale presented in the Consolidated Statement of Financial Position as of December 31, 2012.

On August 30, 2013, the Company entered into an agreement (the “Amended SAPA”) amending and restating the SAPA. The Amended SAPA provides for, among other

things, a series of deferred closings that will take place in certain foreign jurisdictions following the initial closing under the Amended SAPA. The deferred closings will

implement the legal transfer of the Business to KPP subsidiaries in the deferred closing foreign jurisdictions in accordance with local law. Pursuant to the Amended SAPA,

Kodak will operate the Business relating to the deferred closing jurisdictions, subject to certain covenants, until the applicable deferred closing occurs, and will deliver to (or

receive from) a KPP subsidiary at each deferred closing a payment reflecting the actual economic benefit (or detriment) to the Business in the applicable deferred closing

jurisdiction(s) from September 1, 2013 through the time of the applicable deferred closing. Up to the time of the deferred closing, the results of the operations of the Business

will be reported as Earnings (loss) from discontinued operations, net of income taxes in the Consolidated Statement of Operations and the assets and liabilities of the Business

will be categorized as Assets held for sale or Liabilities held for sale in the Consolidated Statement of Financial Position, as appropriate.

110