Kodak 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

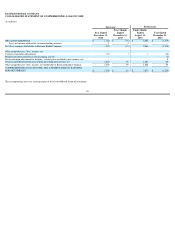

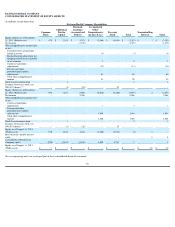

EASTMAN KODAK COMPANY

NOTES TO FINANCIAL STATEMENTS

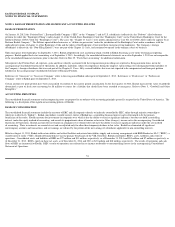

NOTE 1: BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

On January 19, 2012 (the “Petition Date”), Eastman Kodak Company (“EKC” or the “Company”) and its U.S. subsidiaries (collectively, the “Debtors”) filed voluntary

petitions for relief (the “Bankruptcy Filing”) under chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the

Southern District of New York (the “Bankruptcy Court”). The cases (the “Chapter 11 Cases”) were jointly administered as Case No. 12-10202 (ALG) under the caption “In re

Eastman Kodak Company.” The Debtors operated their businesses as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the

applicable provisions of chapter 11 of the Bankruptcy Code and the orders of the Bankruptcy Court until their emergence from bankruptcy. The Company’s foreign

subsidiaries (collectively, the “Non-Filing Entities”) were not part of the Chapter 11 Cases, and continued to operate in the ordinary course of business.

Upon emergence from bankruptcy on September 3, 2013, Kodak adopted fresh-start accounting which resulted in Kodak becoming a new entity for financial reporting

purposes. Kodak applied fresh start accounting as of September 1, 2013. Accordingly, the consolidated financial statements on or after September 1, 2013 are not comparable

to the consolidated financial statements prior to that date. Refer to Note 25, “Fresh Start Accounting” for additional information.

Subsequent to the Petition Date, all expenses, gains and losses directly associated with the reorganization proceedings are reported as Reorganization items, net in the

accompanying Consolidated Statement of Operations. In addition, Liabilities subject to compromise during the chapter 11 proceedings were distinguished from liabilities of

the Company’s foreign subsidiaries that were not part of the Chapter 11 Cases, fully-secured liabilities that were not expected to be compromised and from post-petition

liabilities in the accompanying Consolidated Statement of Financial Position.

References to “Successor” or “Successor Company” relate to the reorganized Kodak subsequent to September 3, 2013. References to “Predecessor” or “Predecessor

Company” relate to Kodak prior to September 3, 2013.

Certain amounts for prior periods have been reclassified to conform to the current period classification. In the first quarter of 2014, Kodak increased the value of goodwill

determined as part of fresh start accounting by $8 million to correct for a liability that should have been recorded at emergence. Refer to Note 5, “

Goodwill and Other

Intangibles.”

ACCOUNTING PRINCIPLES

The consolidated financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. The

following is a description of the significant accounting policies of Kodak.

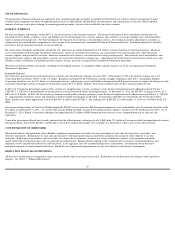

BASIS OF CONSOLIDATION

The consolidated financial statements include the accounts of EKC and all companies directly or indirectly controlled by EKC, either through majority ownership or

otherwise (collectively “Kodak”). Kodak consolidates variable interest entities if Kodak has a controlling financial interest and is determined to be the primary

beneficiary of the entity. Kodak accounts for investments in companies over which it has the ability to exercise significant influence, but does not hold a controlling

interest, under the equity method of accounting, and records its proportionate share of income or losses in Other (charges), income net in the accompanying Consolidated

Statements of Operations. Kodak accounts for investments in companies over which it does not have the ability to exercise significant influence under the cost method

of accounting. These investments are carried at cost and are adjusted only for other-than-temporary declines in fair value. Kodak has eliminated all significant

intercompany accounts and transactions, and net earnings are reduced by the portion of the net earnings of subsidiaries applicable to non-controlling interests.

Effective August 31, 2013, Kodak sold certain utilities and related facilities and entered into utilities supply and servicing arrangements with RED-Rochester, LLC (“RED”),

a

variable interest entity (“VIE”). Kodak determined that it was the primary beneficiary of the VIE. Therefore, Kodak consolidates RED’s assets, liabilities and results of

operations. Consolidated assets and liabilities of RED are $77 million and $11 million, respectively, as of December 31, 2014 and $85 million and $7 million, respectively, as

of December 31, 2013. RED’s equity in those net assets as of December 31, 2014 and 2013 is $21 million and $18 million, respectively. The results of operations and cash

flows of RED are immaterial to Kodak. RED’s results of operations are reflected in net income attributable to noncontrolling interest in the accompanying Consolidated

Statement of Operations.

54