Kia 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

097_

Kia Motors Annual Report 2007

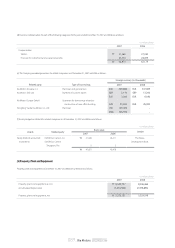

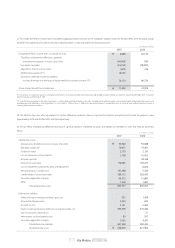

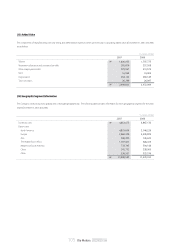

(d) The Company is involved in lawsuits pertaining to disputes with the Brazilian shareholders of Asia Motors Do Brasil S.A. (AMB), which was established as a joint

venture by Asia Motors with a Brazilian investor. In 2002, the Company, a shareholder of AMB, brought one of the cases to the International Court of Arbitration to

settle disputes pursuant to the terms of the contract signed at inception of the joint venture which states that where the business has been adversely affected by a

party’s failure to comply with the contract terms or other reasons, the matter should be taken before the International Court of Arbitration for settlement and parties

shall be held accountable according to the ruling. The case was decided in favor of the Company by the International Count of Arbitration on July 22, 2004. The

Company has subsequently written off this investment of ₩14,057 million.

Although the outcome of this case as well as the other 3 lawsuits is not currently predictable, management believes that the resolution of these matters will not

have a material adverse effect on the operations or financial position of the Company.

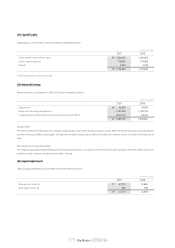

(e) The Company entered into an agreement with its European sales subsidiaries and agents that they would be responsible for the projected costs of dismantling

and recycling vehicles sold in their respective countries to comply with the European Parliamentary directive regarding End-of-Life vehicles (ELV).

(f) The Company entered into a contract with Hyundai Powertech Co., Ltd. on , December 10, 2007 to sell a portion of the land located on the Seosan industrial

complex currently under construction with estimated completion in 2010. The preliminary contract amount is ₩115,371 million which is subject to change upon

completion of the complex when final costs are determined. The Company received down payment amounting to ₩92,297 million recorded as advance deposit

for sale of land as of December 31, 2007.

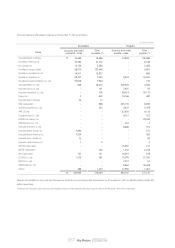

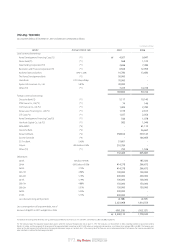

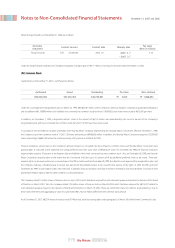

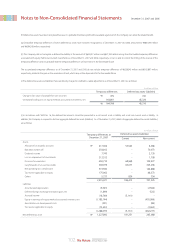

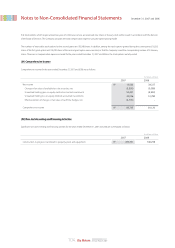

(22) Derivative Instruments

The Company has entered into range forwards and foreign exchange forwards to hedge its exposure to variability in the functional-currency-equivalent cash flows

associated with the fluctuation risk of foreign exchange rates. In addition, the Company entered into interest rate and currency swaps to hedge interest rate risks

and floating rate foreign currency debt exposures.

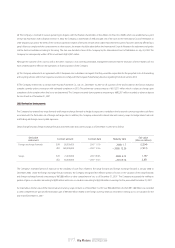

Detail of range forwards, foreign exchange forwards and interest rate and currency swaps as of December 31, 2007 are as follows:

The Company’s estimated period of exposure to the variability of cash flows related to the range forwards and foreign exchange forwards is January 2008 to

December 2008. Under the foreign exchange forward contracts, the Company recognized the effective portion of losses on the valuation of the range forwards

and foreign exchange forwards amounting to ₩7,888 million as other comprehensive loss, as of December 31, 2007. The Company recognized the ineffective

portion of gains on valuation amounting to ₩99 million and losses on valuation amounting to ₩2,418 million in earnings for the year ended December 31, 2007.

As noted above, the fair value of the interest rate and currency swap contracts as of December 31, 2007 was ₩4,648 million of which ₩1,188 million was recorded

as other comprehensive gain and the translation gain of ₩3,460 million related to the foreign currency debt was recorded in earnings as loss on valuation for the

year ended December 31, 2007.

120,000,000

820,000,000

21,000,000

155,000,000

EUR

USD

EUR

USD

2007. 11.19

~ 2007. 12.26

2007. 09.05

~ 2007. 10.23

2008. 1. 7

~ 2008. 12.29

2008. 9.12

~2010.9.14

(2,294)

(7,913)

1,797

2,851

Maturity date

Contract dateContract amount

Derivative

instrument

Fair value

(Won in millions)

Foreign exchange forwards

Swaps