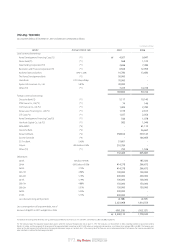

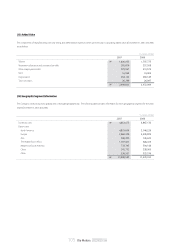

Kia 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

096_

Kia Motors Annual Report 2007

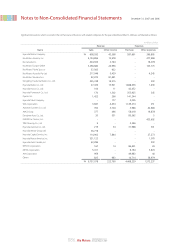

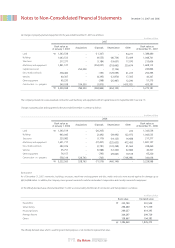

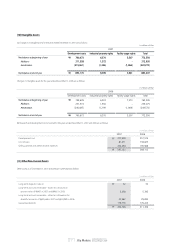

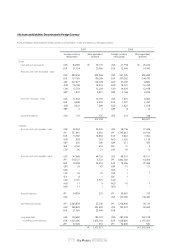

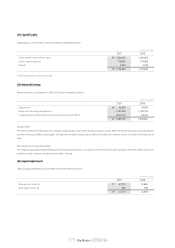

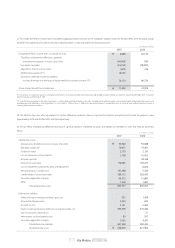

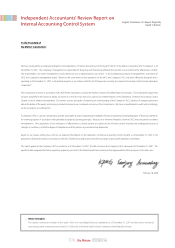

(19) Provision for Warranties and Card Points

Changes in provision for warranties and card points for the years ended December 31, 2007 and 2006 are summarized as follows:

The Company maintains insurance to cover potential product liabilities up to US$85,000 thousand in North America and Europe and ₩1,000 million in Korea as of

December 31, 2007.

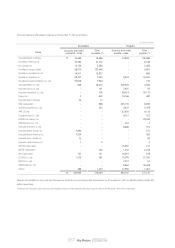

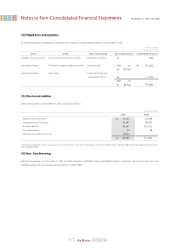

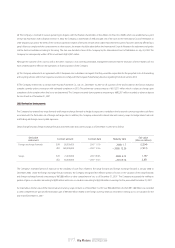

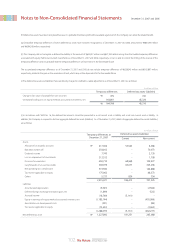

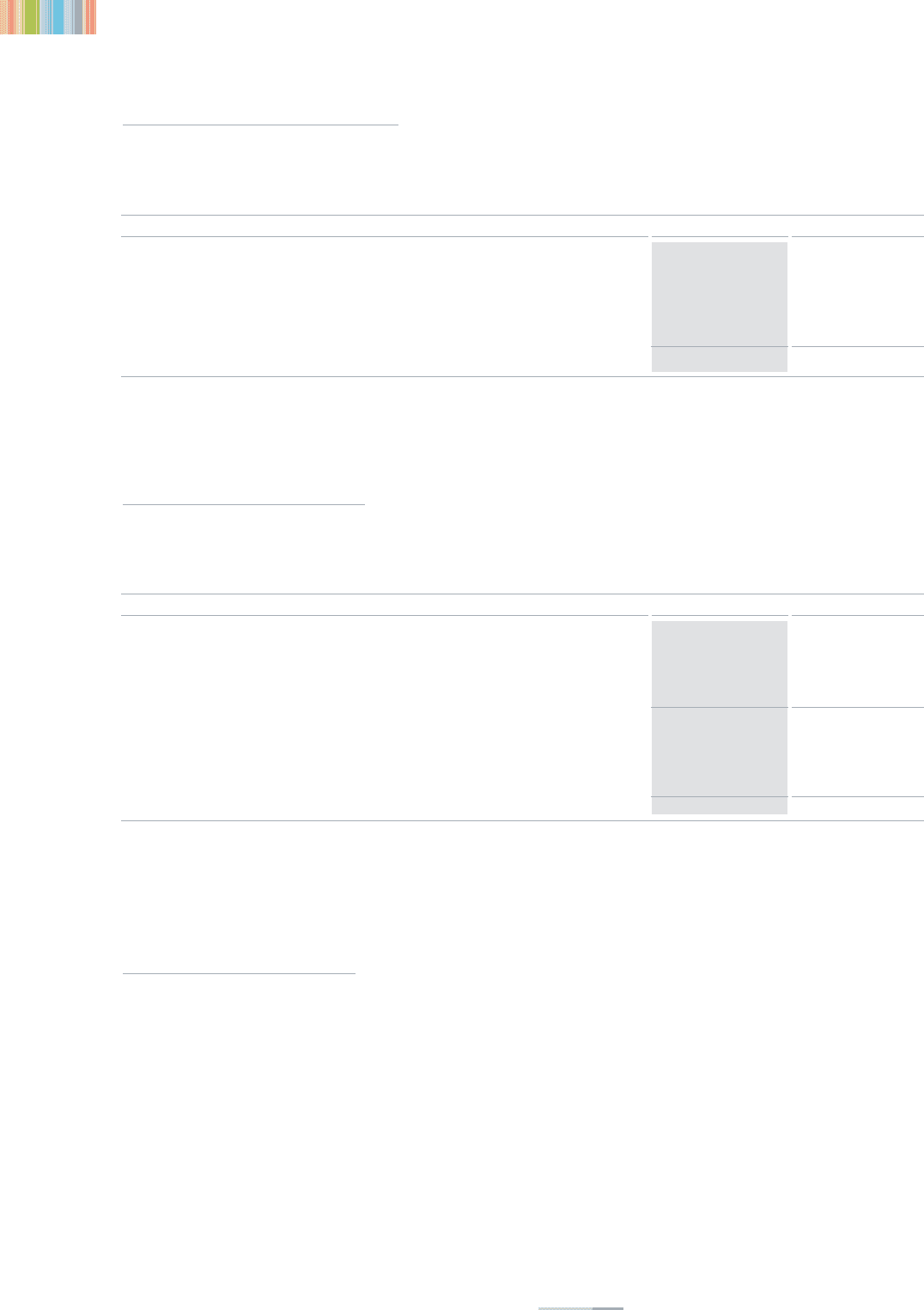

(20) Retirement and Severance Benefits

Changes in retirement and severance benefits for the years ended December 31, 2007 and 2006 are summarized as follows:

The Company maintains an employees’ severance benefit insurance arrangement with the Samsung Life Insurance Co., Ltd. and others. Under this arrangement,

the Company has made a deposit in the amount equal to 63.00% and 60.48% of the reserve balances of retirement and severance benefits as of December 31, 2007

and 2006, respectively. This deposit is to be used to guarantee the required payments to prior employees and accounted for as a reduction of the reserve balance.

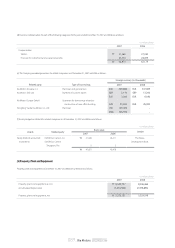

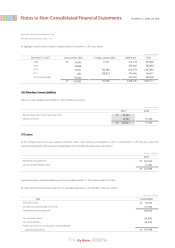

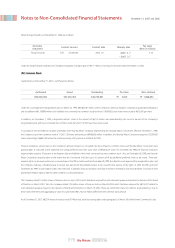

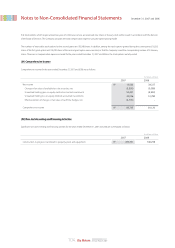

(21) Commitments and Contingencies

(a) The Company provides guarantees for certain customers’ financing relating to long-term installment sales. The oustanding amount for which the Company has

provided guarantee to the respective financial institutions was ₩7,147 million as of December 31, 2007. However, these guarantees are covered by insurance

contracts in which the Company is the beneficiary of the claim amount if the customer defaults.

(b) As of December 31, 2007, 32 blank checks, 95 blank promissory notes and two promissory notes totaling ₩1,820 million have been provided as collateral to

Standard Chartered First Bank Korea Ltd. and others for the Company’s debts (see note 15).

(c) The Company is involved in 25 lawsuits. Claims for alleged damages, which arose in the ordinary course of business total ₩17,753 million as of December 31,

2007. No provision is recorded as of December 31, 2007. Management is of the opinion that the foregoing lawsuits and claims will not have a material adverse effect

on the Company’s financial position, operating results or cash flows.

* The provision for card points is ₩5,724 million and ₩3,528 million as of December 31, 2007 and 2006, respectively.

December 31, 2007 and 2006

Notes to Non-Consolidated Financial Statements

703,489

205,765

(258,544)

650,710

₩

₩

2007 2006

724,152

246,556

(267,219)

703,489

Net balance at beginning of year

Provision

Payment

Net balance at end of year*

In millions of Won

1,407,626

285,676

640

(516,929)

1,177,013

(16,225)

(741,474)

419,314

₩

₩

2007 2006

1,522,784

357,508

10

(472,676)

1,407,626

(24,788)

(851,383)

531,455

Estimated retirement and severance benefits at beginning of year

Provision for retirement and severance benefits

Transfer-in from associate companies

Payments

Estimated retirement and severance benefits at end of year

Transfer to National Pension Fund

Deposit for severance benefit insurance

Net balance at December 31, 2007

In millions of Won