Kia 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

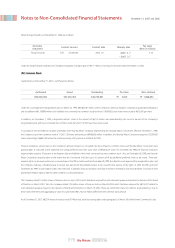

IR Activities in 2007

January Conference for 2006 Operating Results and 2007 Business Plan

February Non-Deal Road Show in US/Europe/Asia

March Annual General Shareholder's Meeting and Annual Report Release (Korean)

Investors Conference in Seoul by Citigroup

April Investors Conference in New York by Morgan Stanley

European Operations(Plant/Sales Subsidiary/R&D Center) Visit (for Credit/Equity Analysts)

Annual Report Release (English)

May Conference for 1st Quarter Operating Results

Non-Deal Road Show in US/Europe/Asia

June cee'd Test-drive (for Analysts, Institutional Investors)

July Conference for 1st Half Operating Results

September Investors Conference in New York by Deutsche

October Conference for 3rd Quarter Operating Results

Investors Conference in Singapore by Woori Securities

November Non-Deal Road Show in US/Europe/Asia

Investors Conference in Seoul by UBS

Corporate Credit Ratings Annual Review (Moody's, Standard & Poor's)

December Year-end Small Group Meetings with Analysts

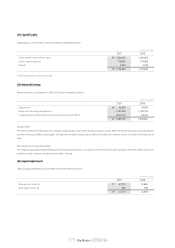

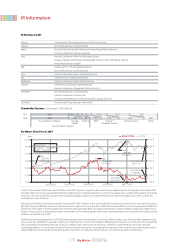

Shareholder Structure (at December 31, 2007/2006 ; %)

2007 38.67 0.00 1.99 7.12 9.74 16.11 26.37

2006 38.67 1.26 1.99 7.25 10.10 22.53 18.20

Hyundai Motor Company Hyundai ES Chung ESOP Domestic Foreign Investors Others

Capital

Institutional Investors

Hyundai Motor Company

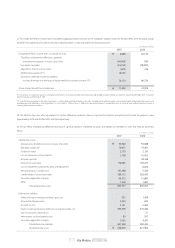

Kia Motors Share Price in 2007

In 2007, the benchmark KOSPI index soared 32.3% to end at 1,897.13 points, compared to the end of last year. Supported by the strong global stock market, KOSPI

exceeded 2,000 points showing upward trend thanks to improvement in corporate performance, strong China-related stocks, and abundant capital in stock market.

However, in the second half of the year, due to the widespread volatility in global stock market stemming from subprime mortgage crisis in the U.S., KOSPI also

swung between gains and losses.

Stock prices of Kia Motors have increased steadily in the first half of 2007. However, in the second half of the year, the stock prices turned to downturn and closed at

₩10,100, down by 24.9% from the previous year. Kia turned to a surplus in the second quarter of 2007 after recording deficit since the second quarter of 2006. But it

turned into a deficit again in the third quarter with weak stock prices due to the delay in production during strike. Increased volatility in global stock market forced

foreign investors to go on a selling spree in Korean stock market in 2007 and the proportion of Kia shares owned by foreigners has decreased from 22.5% at the end

of 2006 to 16.1% at the end of 2007.

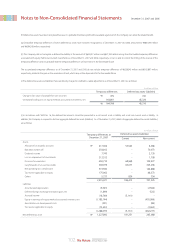

Kia Motors recorded operating deficit in 2007 following the previous year. However thanks to continuous efforts to reduce costs, deficit has fallen compared to the

previous year. Kia’s profitability is expected to improve as competitive new cars will hit the market in 2008 along with innovation in cost structure. Kia conveyed mid-

and long-term growth momentum through continuous communication with investors at road shows, conferences and IR meetings even when it showed

stagnant performance. As a result, many investors at home and abroad now buy Kia’s stocks, paying keen attention to Kia’s turnaround story after Kia announced in

January 2008 that it recorded surplus in the fourth quarter of year 2007. So, stock price of Kia will recover in line with enhancement in performance.

108_

Kia Motors Annual Report 2007

IR Information

900 P

1,100 P

1,300 P

1,500 P

1,700 P

1,900 P

2,100 P

Low

9,330 KRW

(07-10-22)

End of 2007

10,100 KRW

(KRW) KIA MOTORS KOSPI

2007-02-28 2007-04-30 2007-06-30 2007-08-30 2007-10-30

9000

End of 2007

1,897.13P

End of 2006

Kia Mortors : 13,450 KRW

KOSPI : 1,434.46 P

21,000

19,000

17,000

15,000

13,000

11,000

Low

1,355.79P

(07-01-10)

High

15,250 KRW

(07-07-24)

High

2,064.85P

(07-10-31)