Kia 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101_

Kia Motors Annual Report 2007

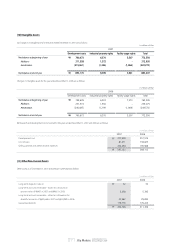

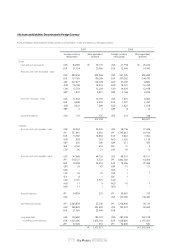

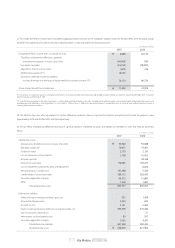

(c) The charge (benefit) for income taxes calculated by applying statutory tax rates to the Company’s taxable income for the year differs from the actual charge

(benefit) in the statement of income for the years ended December 31, 2007 and 2006 for the following reasons:

(d) The effective tax rates, after adjustments for certain differences between amounts reported for financial accounting and income tax purposes, were

approximately 45.7% and 46.3% in 2007 and 2006, respectively.

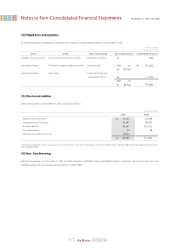

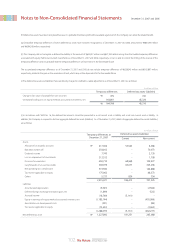

(e) The tax effects of temporary differences that result in significant portions of deferred tax assets and liabilities at December 31, 2007 and 2006 are presented

below:

6,866

(64,669)

(24,356)

(609)

18,003

76,170

11,405

₩

₩

2007 2006

20,120

286

(78,039)

739

-

90,770

33,876

Charge (benefit) for income taxes at nominal tax rates

Tax effects of permanent differences, primarily

entertainment expenses in excess of tax limit

Investment tax credit

Adjustment of prior year tax return

Additional tax payment(*1)

Decrease in deferred income tax liabilities

resulting from equity in earnings of equity method accounted investees (*2)

Actual charge (benefit) for income taxes

In millions of Won

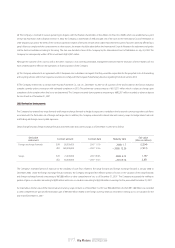

59,929

70,073

2,130

1,708

-

178,945

-

142,888

388,113

48,373

1,578

893,737

522

2,564

5,161

455,999

-

89

3,063

467,398

426,339

₩

₩

2007 2006

59,688

72,461

2,130

10,053

38,346

193,227

6,876

5,324

363,415

51,800

1,687

805,007

1,434

935

5,065

370,440

31

557

4,581

383,043

421,964

Deferred tax assets

Allowance for doubtful accounts in excess of tax limit

Bad debts written off

Dividend income

Loss on impairment of investments

Accrued expenses

Provision for warranties

Loss on impairment of property, plant and equipment

Net operating loss carryforward

Carryforwards of unused tax credits

Tax reserve applicable to equity

Other

Total deferred tax assets

Deferred tax liabilities

Deferred foreign exchange translation gain, net

Accumulated depreciation

Accrued income

Equity in earnings of equity method accounted investees, net

Gain on valuation of derivatives

Amortization on development costs

Tax reserve applicable to equity

Total deferred tax liabilities

Net deferred tax asset

In millions of Won

(*1) The Company was subject to a special tax investigation by the National Tax Service during 2007 related to fiscal years 2001 to 2006, resulting in additional tax payments amounting to ₩18,003 which is included in

income tax payable as of December 31, 2007.

(*2) Under the Corporate Income Tax Act Article 18 paragraph 2, a certain portion of dividend income is not taxable. Therefore, certain portions of equity in net earnings of equity method accounted investees were

considered permanent differences in estimating deferred tax assets (liabilities). Effective January 1, 2006, non-taxable dividend income is excluded from equity in income of equity method accounted investees in

estimating deferred income tax liabilities.