Kia 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

064_

Kia Motors Annual Report 2007

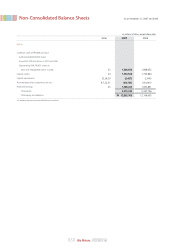

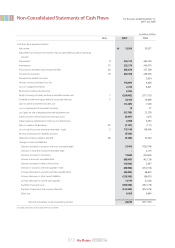

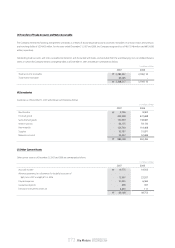

Non-Consolidated Statements of Cash Flows

For the years ended December 31,

2007 and 2006

In millions of Won

2007 2006

Cash flows from investing activities

Net proceeds from withdrawal of short-term deposits

Proceeds from withdrawal of long-term deposits

Proceeds from sale of available-for-sale securities

Proceeds from sale of held-to-maturity securities

Proceeds from sale of equity method accounted investments

Proceeds from sale of property, plant and equipment

Proceeds from sale of memberships

Refund of security deposits

Payment from deposit for severance benefit insurance

Proceeds from advance deposit for sale of land

Proceeds from advance receipt for Property, plant and equipment

Purchase of available-for-sale securities

Purchase of held-to-maturity securities

Purchase of equity method accounted investments

Purchase of property, plant and equipment

Additions to intangible assets

Payment of security deposits

Purchase of memberships

Contribution to deposit for severance benefit insurance

Net cash used in investing activities

Cash flows from financing activities

Proceeds from short-term borrowings, net

Proceeds from long-term debt

Proceeds from sales-leaseback obligation

Repayment of current portion of long-term debt

Repayment of long-term debt

Payment of sales-leaseback obligation

Dividends paid

Proceeds from deposits received, net

Proceeds from exercise of stock options

Net cash provided by financing activities

Net increase (decrease) in cash and cash equivalents

Cash and cash equivalents at beginning of year

Cash and cash equivalents at end of year

20,000

-

29,141

3,936

-

86,603

4,926

9,879

257,343

92,297

2,642

(9)

(8,886)

(410,402)

(534,550)

(312,930)

(11,399)

(1,524)

(147,434)

(920,367)

313,038

1,002,573

250,000

(502,546)

-

(7,618)

-

1,032

951

1,057,430

165,303

521,608

686,911

100,000

122

3,219

472

4,668

50,300

534

8,308

241,262

-

(64)

(2,650)

(385,713)

(528,763)

(259,075)

(10,142)

(24,935)

(158,604)

(961,061)

350,843

861,305

-

(259,267)

(58,735)

-

(86,623)

(926)

898

807,495

(385,116)

906,724

521,608

Note

9

20

16,21

7

9

10

20

17

17

30

₩

₩

See accompanying notes to non-consolidated financial statements.