Kia 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

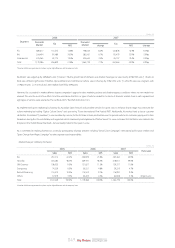

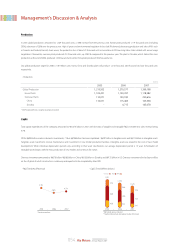

Production

In 2007, global production amounted to 1,369 thousand units, a 7.8% increase from the previous year. Korean plant produced 1,119 thousand units (including

OEM), a decrease of 2.8% over the previous year. High oil prices and environmental regulation led to slack RV demand, decreasing production and sales of RVs such

as Sorento and Sedona(Carnival). Even worse, the production loss of about 23 thousand units occurred due to 90 hour-long labor strikes related with annual wage

negotiations. Meanwhile, overseas plant produced 251 thousand units, up 108.5 % compared to the previous year. The plant in Slovakia, which started the mass

production at the end of 2006, produced 145 thousand units while China plant produced 106 thousand units.

Our global production target for 2008 is 1.69 million units. Korea, China and Slovakia plant will produce 1,215 thousand, 250 thousand and 225 thousand units

respectively.

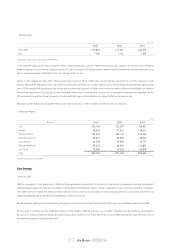

・Production

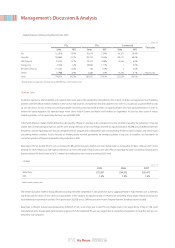

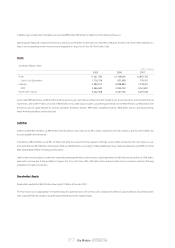

CapEx

Total capital expenditures of the company amounted to ₩1,570 billion in 2007, with the ratio of tangible and intangible R&D investment to sales revenue being

4.7%.

Of the ₩994 billion made in domestic investments, 71% or ₩708 billion has been capitalized - ₩397 billion in tangible assets and ₩312 billion in intangible assets.

Tangibles asset investments involve maintenance and investment in new model production facilities. Intangible assets are related to the cost of new model

development. While individual depreciation periods vary according to their asset classification, our average depreciation period is 15 years. Amortization of

intangible assets begins with the mass production of new models and continues for 3 years.

Overseas investment amounted to ₩576 billion: ₩286 billion in China, ₩156 billion in Slovakia, and ₩135 billion in US. Overseas investment for the future will be

on the US plant of which construction is underway and expected to be completed by late 2009.

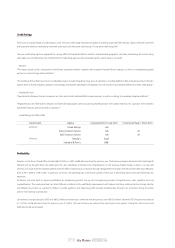

・R&D Trend (% of Revenue)

054_

Kia Motors Annual Report 2007

Management’s Discussion & Analysis

・CapEx Trend (KRW in billions)

* Parent revenue base

5.9%

4.6% 4.7%

2005 2006 2007

* R&D related expenses included

** CapEx in China includes local partner's burden (50% shares)

2005 2006 2007

1,570

1,709

588

799

1,911

534

949

322

428

576

753

241

Overseas R&D PP&E

1,270,577

1,150,397

120,180

115,465

4,715

2006

1,215,502

1,105,431

110,071

110,071

-

2005 2007

1,369,198

1,118,582

250,616

105,538

145,078

Global Production

Korea Plants

Overseas Plants

China

Slovakia

(Units)

* OEM Production(Picanto - Donghee Automotive) included