Kia 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

069_

Kia Motors Annual Report 2007

The Company recognizes interest costs and other financial charges on borrowings associated with the production, acquisition, construction of property, plant and

equipment as an expense in the period in which they are incurred.

The Company reviews the property, plant and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an

asset may not be recoverable. An impairment loss would be recognized when the expected estimated undiscounted future net cash flows from the use of the

asset and its eventual disposal are less than its carrying amount.

(k) Leases

The Company classifies and accounts for leases as either operating or capital leases, depending on the terms of the lease. Leases where the Company assumes

substantially all the risks and rewards of ownership are classified as capital leases. All other leases are classified as operating leases.

Substantially all the risks and rewards of ownership is evidenced when one or more of the criteria listed below are met:

- Ownership of the leased property will transfer to the lessee at the end of the lease term.

- The lessee has a bargain purchase option, and it is reasonably certain at the inception of the lease that the option will be exercised.

- The lease term is equal to 75% or more of the estimated economic useful life of the leased property.

- The present value at the beginning of the lease term of the minimum lease payments equals or exceeds 90% of the fair value of the leased property.

In addition, if the leased property is specialized to the extent that only the lessee can use it without any major modification, it is considered a capital lease.

Payments made under operating leases are charged to the income statement on a straight-line basis over the period of the lease.

Where the Company is a lessee under a capital lease, the present value of future minimum lease payments is capitalized and a corresponding liability is recognized.

In a sale and leaseback contract, the Company recognizes the sale and leaseback transaction, respectively. However, the Company does not immediately recognize

any excess of sales proceeds over the carrying amount as gain, but defers and amortizes the amout over the lease term.

(l) Intangible Assets

An intangible asset is an asset where: (1) it is probable that future economic benefits that are attributable to the asset will flow into the entity and (2) the cost of the

asset can be measured reliably.

Intangible assets are stated at cost less accumulated amortization and impairment losses, if any. Impairment losses are determined as the amount required to

reduce the carrying amount of an intangible asset to its recoverable amount.

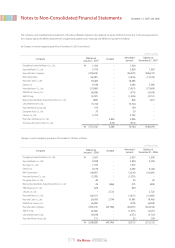

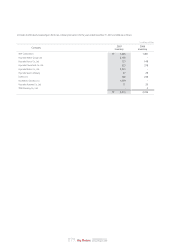

The criteria for determining whether an incurred cost qualifies as an intangible asset and the periods of amortization for each classification of intangible asset are

described below:

(i) Research and Development Costs

To assess whether an internally generated intangible asset meets the criteria for recognition, the Company classifies the process into a research phase and a

development phase. All costs incurred during the research phase are expensed as incurred. Costs incurred during the development phase are recognized as

assets only if all of the following criteria are met in accordance with SKAS No. 3, Intangible Assets:

(1) Completion of the intangible asset is technically feasible so that it will be available for use or sale; (2) the Company has the intention and ability to complete

the development of the intangible asset and use or sell it; (3) there is evidence that the intangible asset will generate probable future economic benefit; (4) the

Company has adequate technical, financial and other resources to complete the development of the intangible asset and the intangible asset will be available;

and (5) the expenditures attributable to the intangible asset during its development can be reliably determined

If the costs incurred fail to satisfy all of the criteria, they are recorded as periodic expenses as incurred. Capitalized development cost is amortized on a straight-

line basis over the expected periods to be benefited, generally three years. Expenditures subject to capitalization include the cost of materials, direct labor and

an appropriate proportion of overheads.