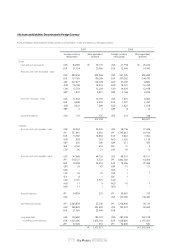

Kia 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102_

Kia Motors Annual Report 2007

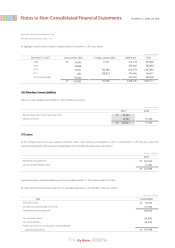

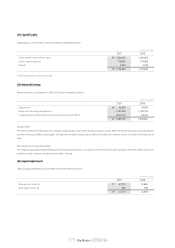

(f) Deferred tax assets have been recognized because it is probable that future profit will be available against which the Company can utilize the related benefit.

(g) Deductible temporary differences of which deferred tax assets have not been recognized as of December 31, 2007 and 2006 amounted to ₩800,390 million

and ₩594,508 million, respectively.

(h) The Company did not recognize a deferred tax liability in the amount of ₩22,407 million and ₩21,952 million arising from the taxable temporary differences

associated with equity method accounted investments as of December 31, 2007 and 2006, respectively, since it is able to control the timing of the reversal of the

temporary differences and it is probable that the temporary differences will not reverse in the foreseeable future.

The accumulated temporary differences as of December 31, 2007 and 2006 do not include temporary differences of ₩258,945 million and ₩261,897 million,

respectively, related to the gain on the revaluation of land, which may not be disposed of in the foreseeable future.

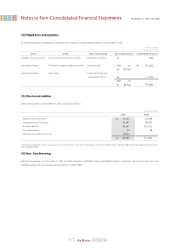

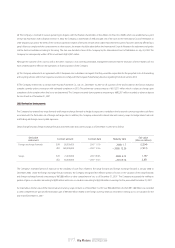

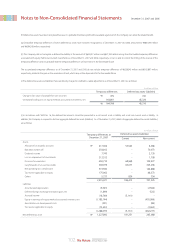

(i) The deferred tax assets and liabilities that were directly charged or credited to capital adjustments as of December 31, 2007 are as follows:

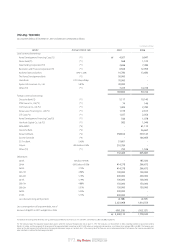

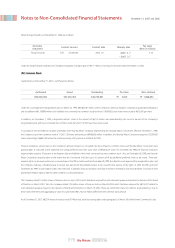

(i) In accordance with SKAS No. 16, the deferred tax amounts should be presented as a net current asset or liability and a net non-current asset or liability. In

addition, the Company is required to disclose aggregate deferred tax assets (liabilities). As of December 31, 2007, details of aggregate deferred tax assets (liabilities)

are as follows:

(35)

164,801

164,766

₩

₩

Temporary differences Deferred tax assets (liabilities)

(10)

45,320

45,310

Change in fair value of available-for-sale securities

Unrealized holding loss on equity method accounted investments, net

In millions of Won

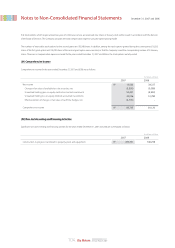

217,924

254,812

7,745

313,512

650,710

369,979

519,590

175,962

5,737

2,515,971

(9,323)

(1,899)

(18,769)

(1,185,144)

(321)

(72,623)

(1,288,079)

1,227,892

₩

₩

Temporary differences at

December 31, 2007

53,543

-

-

-

68,968

63,077

-

-

824

186,412

-

-

(5,161)

-

-

-

(5,161)

181,251

6,386

70,073

2,130

1,708

109,977

325,036

142,888

48,373

754

707,325

(2,564)

(522)

-

(455,999)

(89)

(3,063)

(462,237)

245,088

Non-currentCurrent

Deferred tax assets (liabilities)

Assets

Allowance for doubtful accounts

Bad debts written off

Dividend income

Loss on impairment of investments

Provision for warranties

Carryforwards of unused tax credits

Net operating loss carryforward

Tax reserve applicable to equity

Others

Liabilities

Accumulated depreciation

Deferred foreign exchange translation gain, net

Accrued income

Equity in earnings of equity method accounted investees, net

Amortization on development costs

Tax reserve applicable to equity

Net deferred tax asset

In millions of Won

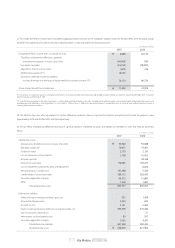

December 31, 2007 and 2006

Notes to Non-Consolidated Financial Statements