Kia 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

072_

Kia Motors Annual Report 2007

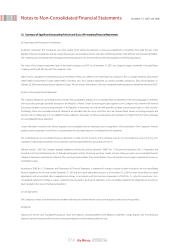

Provision for card points

The Company participates in the card-points program managed by Hyundai Card Co., Ltd., in which the card holders can redeem points to receive discounts when

purchasing the Company’s motor vehicles. A provision is estimated based on points earned and actual points redeemed in the past.

(t) Revenue Recognition

Revenue from the sale of motor vehicles and parts is measured at the fair value of the consideration received or receivable, net of discounts. Revenue is recognized

when the significant risks and rewards of ownership have been transferred to the buyer, recovery of the consideration is probable, the associated costs and possible

return of goods can be estimated reliably, and there is no continuing management involvement with the goods; generally upon delivery to end customer. Revenue

from other than the sale of vehicles and parts is recognized when the Company’s revenue-earning activities have been substantially completed, the amount of

revenue can be measured reliably, and it is probable that the economic benefits associated with the transaction will flow to the Company.

Long-term installment sales are recognized at the time of shipment of motor vehicles and parts when the significant risks and rewards of ownership have been

transferred to buyer. Interest income arising from long-term installment sales contracts is recognized using the level yielding method.

(u) Income Taxes

Income tax on the income or loss for the year comprises of current and deferred tax. Income tax is recognized in the non-consolidated statement of income except

to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted. Deferred tax is provided using the asset and liability method,

providing for temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for tax purposes.

The amount of deferred tax provided is based on the expected manner of realization or settlement of the carrying amount of assets and liabilities, using tax rates

enacted or substantially enacted at the balance sheet date.

A deferred tax asset is recognized only to the extent that it is probable that future taxable income will be available against which the unused tax losses and credits

can be utilized. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benefit will be realized.

Deferred tax assets and liabilities are classified as current or non-current based on the classification of the related asset or liability for financial reporting or the

expected reversal date of the temporary difference for those with no related asset or liability such as loss carryforwards and tax credit carryforwards. The deferred tax

amounts are presented as a net current asset or liability and a net non-current asset or liability.

(v) Earnings (Loss) Per Share

Basic earnings (loss) per share are calculated by dividing net income (loss) by the weighed-average number of shares of common stock outstanding during each

period. Diluted earnings (loss) per share is determined in the same manner as basic earnings per share except that the number of shares is increased and earnings

is decreased assuming exercise of potentially dilutive stock options, unless the effect of such increase would be anti-dilutive.

(w) Use of Estimates

The preparation of non-consolidated financial statements in accordance with accounting principles generally accepted in the Republic of Korea requires

management to make estimates and assumptions that affect the amounts reported in the non-consolidated financial statements and related notes to non-

consolidated financial statements. Actual results could differ from those estimates.

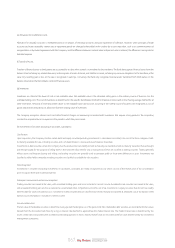

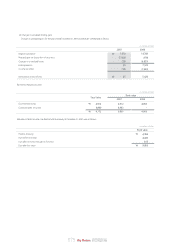

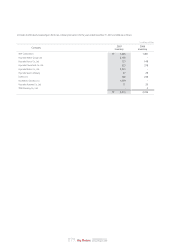

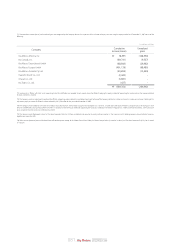

(2) Restricted Deposits

Deposits which are restricted in use as guarantee deposits for maintaining checking accounts as of December 31, 2007 and 2006 are as follows:

December 31, 2007 and 2006

Notes to Non-Consolidated Financial Statements

32

32

₩

₩

2007 2006

32

32

Long-term deposits

In millions of Won