Kia 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

055_

Kia Motors Annual Report 2007

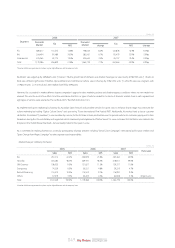

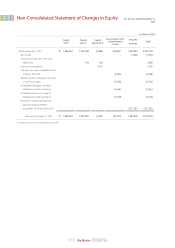

Credit Ratings

There was no change related to credit ratings in 2007. Overseas credit rating maintained a double investment grade (S&P: BBB-, Moody’s: Baa3), and both short-term

and long-term domestic credit ratings remained at the top level (short-term credit rating: A1, long-term credit rating: AA-).

Overseas credit rating agencies appraised the synergy effect of Hyundai-Kia Motors and Kia’s well-diversified geographic sales base, maintaining the current rating

with stable view. The following is the comments from credit rating agencies about maintaining the current rating in June 2007.

・Moody’s

“The rating is based on Kia's solid position in the Korean automotive market - together with its partner Hyundai Motor Company - as well as its strengthening global

position as a result of regional diversification.”

“The two(Kia and Hyundai) have shown considerable progress toward integrating many areas of operations, including platforms, R&D, and parts purchases. Moody's

expects them to further integrate operations and strategy, and that the high degree of integration has not resulted in any material differences in their credit quality.”

・Standard & Poor's

“Operational ties between the two companies are close and include combined R&D and procurement, as well as a strategy to completely integrate platforms.”

“Negative factors are offset by the company's well diversified geographic sales base, growing market position in the global market, its No. 2 position in the domestic

automobile industry, and its favorable cost position.”

・Credit Ratings (As of Mar, 2008)

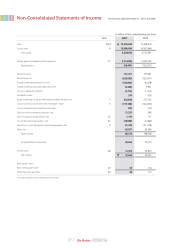

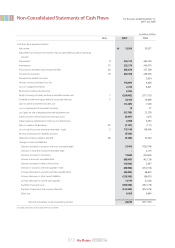

Profitability

Revenue on the basis of head office recorded ₩15.9 trillion in 2007, a 8.6% decrease from the previous year. That’s because exports decreased with slack large RV

demand and we brought down the export price for sales subsidiaries to bolster price competitiveness in the overseas market. Despite a drop in car sales and

revenues, we could lower the operating deficits with the effort of improving cost structure through management innovation. We reduced the deficit by 0.4% point,

from -0.7% in 2006 to -0.3% in 2007. In particular, we had a 2.1% operating gain in the fourth quarter of 2007 due to decreasing fixed cost burden following sales

expansion.

Kia Motors will work hard to improve profitability by broadening product line-up and strengthening product competitiveness, sales capability and cost

competitiveness. The newly launched cars from 2008 will contribute to the profitability improvement with features like these: realizing Kia-Own-Design Identity,

consolidating its position as a global hit model in volume segments and improving profit structure fundamentally through cost innovation during the whole

process from drawing to production.

Our domestic average sales price (ASP) was ₩16.5 milliion, maintaining its same level with the previous year (₩16.5 milliion). However, ASP of exports was reduced

to $12,700, a 6.2% decrease from the previous year ($13,600). That was because we reduced the export price and exports of large RVs like Sorento and

Sedona(Carnival) were lowered.

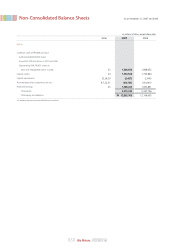

AA-

AA-

AA-

Baa3

BBB-

Corporate Bond / Long-Term

Korea Ratings

Korea Investors Service

NICE Investors Service

Moody's

Standard & Poor's

AgencyClassification Commercial Paper / Short-Term

A1

A1

Domestic

Overseas