Kia 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

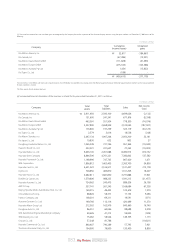

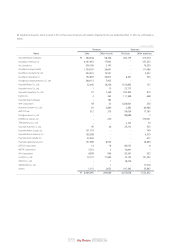

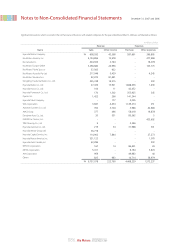

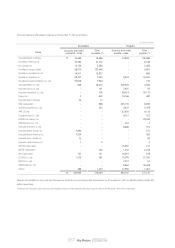

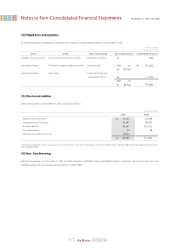

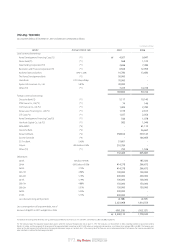

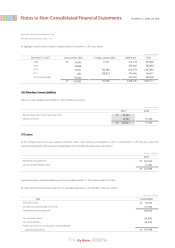

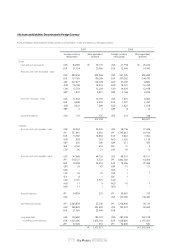

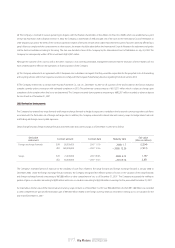

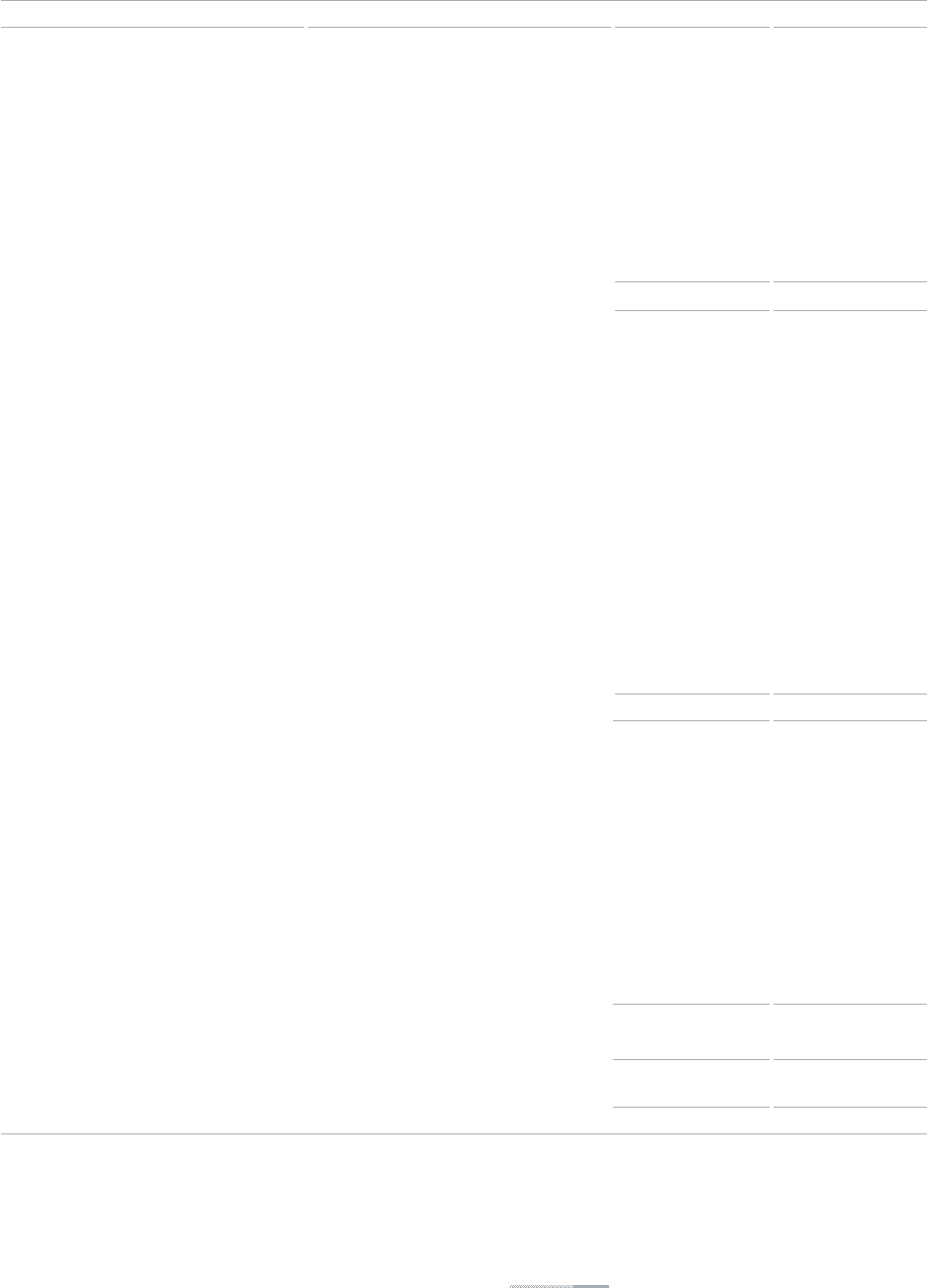

(15) Long - Term Debt

(a) Long-term debt as of December 31, 2007 and 2006 are summarized as follows:

4,927

568

3,696

6,506

10,780

50,000

70,000

30,000

7,415

183,892

5,117

74

1,405

1,319

1,037

544

982

-

-

358,814

-

51,601

310,784

792

732,469

-

414,378

414,378

100,000

200,000

100,000

150,000

150,000

300,000

200,000

(4,788)

2,023,968

(450,219)

2,490,110

2007

Lender Annual interest rate 2006

9,847

1,123

7,389

12,959

13,680

-

-

-

14,726

59,724

10,140

146

2,783

2,613

2,054

1,078

1,946

61,112

36,667

339,143

146,669

-

-

1,536

605,887

185,920

366,672

366,672

100,000

200,000

100,000

150,000

150,000

-

-

(4,705)

1,614,559

(502,127)

1,778,043

Local currency borrowings

Korea Development Financing Corp.(*2)

Woori Bank(*2)

Nara Banking Corporation(*2)

Resolution and Finance Corporation(*2)

Kookmin Bank and others

The Korea Development Bank

Hana Bank

Kyobo Life Insurance Co., Ltd.

Others(*2)

Foreign currency borrowings

Deutsche Bank(*2)

STAR Lease Co., Ltd.(*2)

Citi Financial Co., Ltd.(*2)

Korea Lease Financing Co., Ltd.(*2)

CITI Corp.(*2)

Korea Development Financing Corp(*2)

Han Kook Capital Co., Ltd.(*2)

ABN-AMRO

Deutsche Bank

Korea Eximbank

Societe Generale

SC First Bank

Calyon

Others(*2)

Debentures

263th

264th

265th

266-1th

266-2th

267th

268-1th

268-2th

269th

270th

Less discount (long-term portion)

Less current portion of long-term debt, net of

discount of ₩470 in 2007 and ₩222 in 2006

(*1)

(*1)

(*1)

(*1)

1.0%~5.25%

(*3)

CD 91days+96bp

5.87%

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

(*4)

(*4)

(*4)

(*4)

5.45%

6M Euribor+0.4%

(*1)

3M Libor+0.95%

6M Euribor+0.95%

3.73%

4.98%

5.19%

5.19%

4.88%

5.01%

5.33%

5.73%

In millions of Won

₩

₩

093_

Kia Motors Annual Report 2007

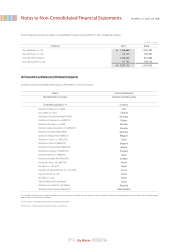

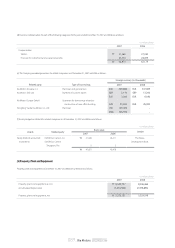

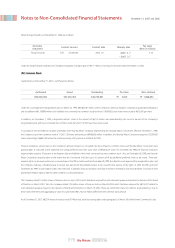

(*1) Based on the earning rate for three-year non-guarantee corporate debentures which was 6.77% and 5.04% at December 31, 2007 and 2006, respectively.

(*2) The Company began the corporate reorganization process under the Company Reorganization Act on April 15, 1998. The Company was released from its debts including liabilities on guarantees totaling

₩5,482,181 million, and the repayment of the principal of the reorganized debts amounting to ₩1,518,942 million was readjusted to be repaid on an installment basis between 2002 and 2008. The Company pays

interest on the debt principal starting from when the reorganization process began on a quarterly basis at the earning rate of the three-year unwarranted corporate bond. Furthermore, the Company provided blank

notes and checks as collateral for these reorganized debts.