Kia 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

074_

Kia Motors Annual Report 2007

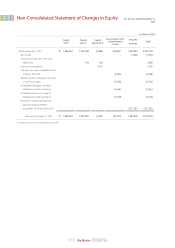

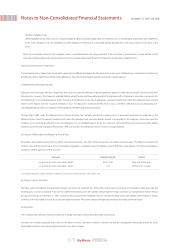

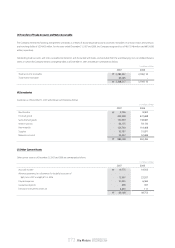

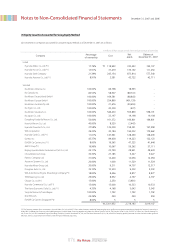

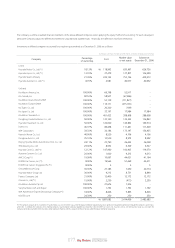

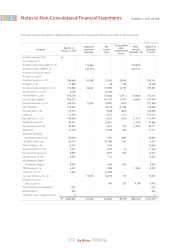

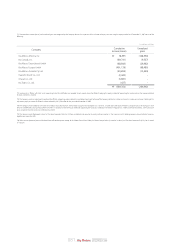

(6) Long-term Investment Securities

Long-term investment securities other than those accounted for using the equity method as of December 31, 2007 and 2006 are summarized as follows:

(a) Available-for-sale securities

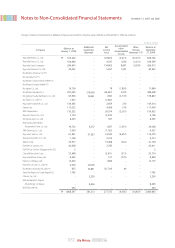

(i) Marketable securities recorded at fair value as of December 31, 2007 and 2006 are summarized as follows:

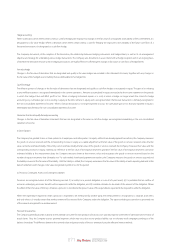

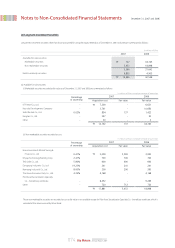

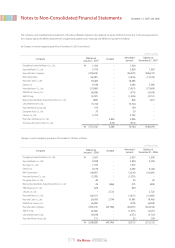

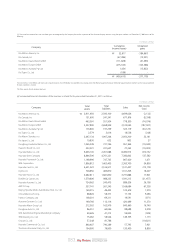

(ii) Non-marketable securities recorded at cost:

These non-marketable securities are recorded at cost as fair value is not available except for Pilot Asset Securitization Specialty Co. - beneficiary certificate, which is

recorded at the value assessed by Woori bank.

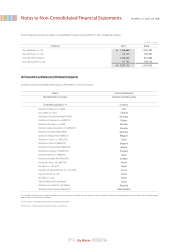

December 31, 2007 and 2006

Notes to Non-Consolidated Financial Statements

137

5,453

5,590

9,855

15,445

₩

₩

2007 2006

18,745

18,898

37,643

4,905

42,548

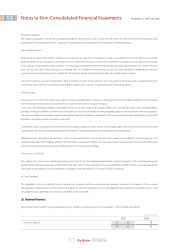

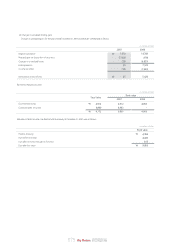

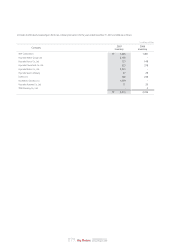

Available-for-sale securities

Marketable securities

Non-marketable securities

Held-to-maturity-securities

In millions of Won

-

-

137

-

-

137

7,200

3,761

854

347

30

12,192

-

-

0.02%

-

-

₩

₩

Fair valueAcquisition cost

Percentage

of ownership Fair value

2007 2006

6,621

10,650

1,422

50

2

18,745

KT Freetel Co., Ltd.

Hyundai Development Company

SeAH Besteel Co., Ltd.

Kanglim Co., Ltd.

Other

In millions of Won, except percentage of ownership

3,000

700

600

241

200

-

-

712

5,453

3,000

700

600

241

200

4,168

8,252

720

17,881

0.41%

2.41%

5.80%

19.23%

8.00%

4.35%

-

-

₩

₩

Fair valueAcquisition cost

Percentage

of ownership Fair value

2007 2006

3,000

700

600

241

200

4,168

9,269

720

18,898

Korea Investment Mutual Saving &

Finance Co., Ltd.

Kihyup Technology Banking Corp.

THE SIGN Co., Ltd.

Dongyung Industries Co., Ltd.

Namyang Industrial Co., Ltd.

The Korea Economic Daily Co., Ltd.

Pilot Asset Securitization Specialty

Co. - beneficiary certificate

Other

In millions of Won, except percentage of ownership