Kia 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104_

Kia Motors Annual Report 2007

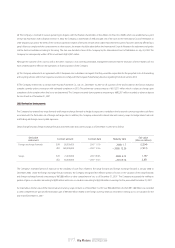

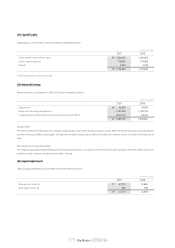

If all stock options, which require at least two-years of continuous service, are exercised, new shares or treasury stock will be issued in accordance with the decision

of the Board of Directors. The Company calculates the total compensation expense using the option-pricing model.

The numbers of exercisable stock options for the second grants are 105,048 shares. In addition, among the stock options granted during the current period, 16,256

shares of the first grant option and 105,030 shares of the second grant option were exercised, so that the Company issued the corresponding number of its treasury

shares. There are no compensation expense incurred for the years ended December 31, 2007 and 2006 as the stock options are fully vested.

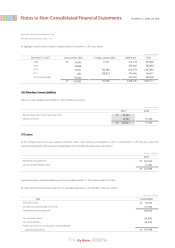

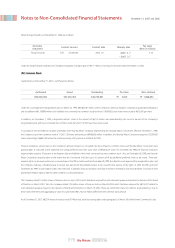

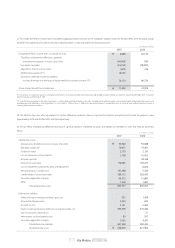

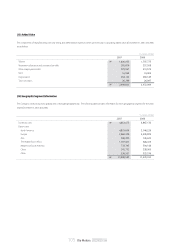

(31) Comprehensive Income

Comprehensive income for the years ended December 31, 2007 and 2006 was as follows:

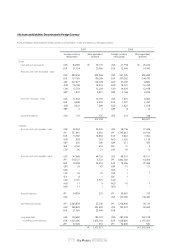

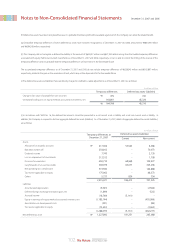

(32) Non-Cash Investing and Financing Activities

Significant non-cash investing and financing activities for the years ended December 31, 2007 and 2006 are summarized as follows:

13,563

(5,595)

50,491

32,036

(6,700)

83,795

₩

₩

2007 2006

39,337

(5,098)

(4,903)

51,784

-

81,120

Net income

Change in fair value of available-for-sale securities, net

Unrealized holding gain on equity method accounted investments

Unrealized holding loss on equity method accounted investments

Effective portion of changes in fair value of cash flow hedges, net

Comprehensive income

In millions of Won

435,331

₩

2007 2006

746,298

Construction-in-progress transferred to property, plant and equipment

In millions of Won

December 31, 2007 and 2006

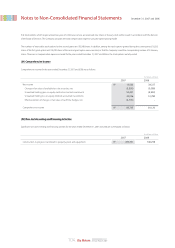

Notes to Non-Consolidated Financial Statements