Kia 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103_

Kia Motors Annual Report 2007

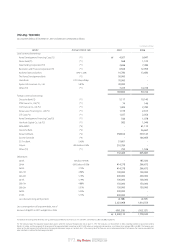

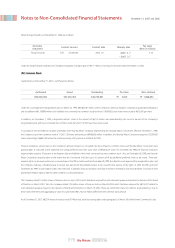

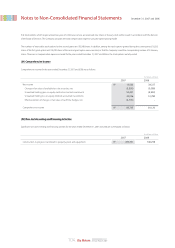

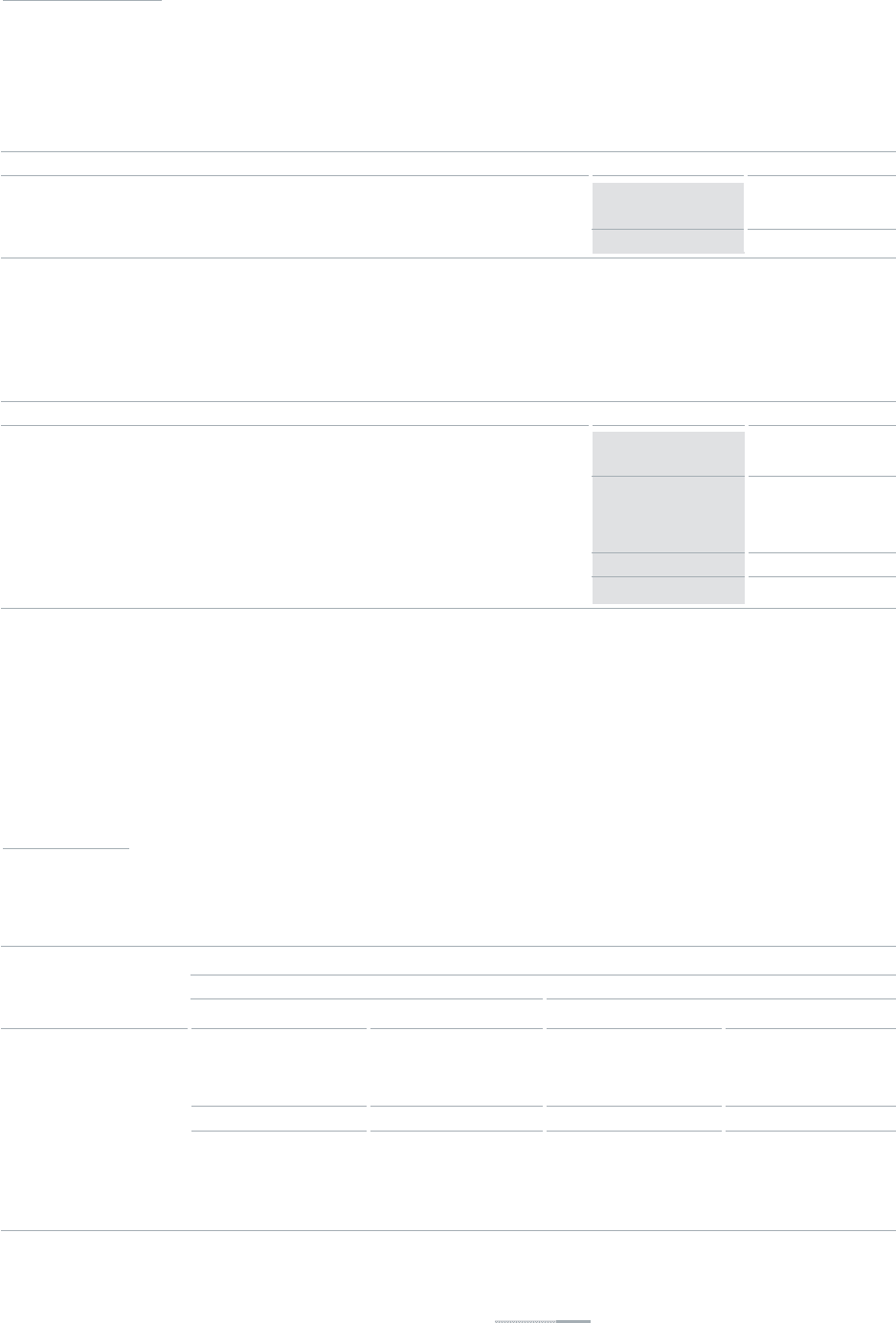

(29) Earnings Per Share

Earnings per share of common stock for the years ended December 31, 2007 and 2006 are calculated as follows:

(a) Basic earnings per share are calculated by dividing net income by the weighted-average number of shares of common stock outstanding.

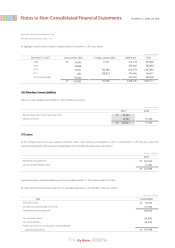

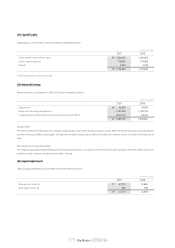

(b) Diluted earnings per share are calculated by dividing net income, as adjusted assuming all potentially dilutive stock options have been exercised, by the

weighted-average number of common and common equivalent shares outstanding.

For the purpose of calculating the weighted-average number of common equivalent shares outstanding, the Company assumed that ordinary shares were issued

upon exercise of the dilutive stock options at the average market price of the ordinary shares during the period. The difference between the number of ordinary

shares issued and the number of ordinary shares that would have been issued at the average market price (₩12,185 and ₩18,335 for the year ended 2007 and

2006, respectively) of ordinary shares during the period is considered as an issue of ordinary shares for no consideration.

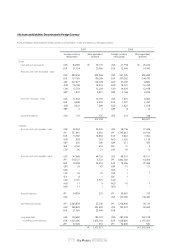

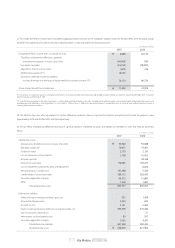

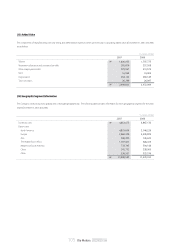

(30) Stock Options

The Company granted stock options to its executive officers and directors in accordance with the stock option plan approved by the Board of Directors. The details

of the stock options granted are as follows:

13,562,942,696

346,635,383

39

₩

₩

2007 2006

39,336,697,185

346,522,839

114

Net income

Weighted-average number of common shares Outstanding

Earnings per share

In Won, except number of shares

13,562,942,696

-

13,562,942,696

346,635,383

75,227

346,710,610

39

₩

₩

2007 2006

39,336,697,185

-

39,336,697,185

346,522,839

186,786

346,709,625

113

Net income

Stock option compensation

Weighted-average number of common shares outstanding

Weighted-average number of common equivalent shares outstanding*

Weighted-average number of common and common equivalent shares outstanding

Diluted earnings per share in Won

Granted

Cancelled

Exercised

Remaining

Grant date

Vesting period

Exercise period

Exercise price

In Won, except number of shares

*2007:[105,048-(105,048×8,200÷12,185)]×(365/365)+[16,256-(16,256×5,500÷12,185)+ 105,030-(105,030×8,200÷12,185)]×( 344/365)

2006:[16,256-(16,256×5,500÷18,335)+210,078-(210,078×8,200÷18,335)]×(365/365)+ [6,667- (6,667×5,500 ÷18,335) + 105,019 - (105,019×8,200 ÷18,335)]×(345/365)

3,735

(125)

(3,610)

-

950,000

(31,655)

(918,345)

-

₩

₩

₩

₩

Compensation expensesNumber of shares Compensation expenses

695,000

(379,903)

(210,049)

105,048

2,974

(1,614)

(910)

450

Number of shares

1st Grant 2nd Grant

Won (millions, except shares)

March 17,2000

2 years from grant date

2003.3.18 ~ 2008.3.17

₩5,500

February 20,2003

2 years from grant date

2006.2.20 ~ 2011.2.19

₩8,200