Kia 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

071_

Kia Motors Annual Report 2007

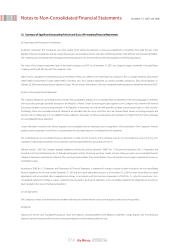

Hedge accounting

Where a derivative, which meets certain criteria, is used for hedging the exposure to changes in the fair value of a recognized asset, liability or firm commitment, it is

designated as a fair value hedge. Where a derivative, which meets certain criteria, is used for hedging the exposure to the variability of the future cash flows of a

forecasted transaction, it is designated as a cash flow hedge.

The Company documents, at the inception of the transaction, the relationship between hedging instruments and hedged items, as well as its risk management

objective and strategy for undertaking various hedge transactions. The Company also documents its assessment, both at hedge inception and on an ongoing basis,

of whether the derivatives that are used in hedging transactions are highly effective in offsetting the changes in fair values or cash flows of hedged items.

Fair value hedge

Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the statement of income, together with any changes in

the fair value of the hedged asset or liability that are attributable to the hedged risk.

Cash flow hedge

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is recognized in equity. The gain or loss relating

to any ineffective portion is recognized immediately in the current operations. Amounts accumulated in equity are recycled to the income statement in the periods

in which the hedged item will affect profit or loss. When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge

accounting, any cumulative gain or loss existing in equity at the time remains in equity and is recognized when the forecast transaction is ultimately recognized in

the non-consolidated statement of income. When a forecast transaction is no longer expected to occur, the cumulative gain or loss that was reported in equity is

immediately transferred to the non-consolidated statement of income.

Derivatives that do not qualify for hedge accounting

Changes in the fair value of derivative instruments that are not designated as fair value or cash flow hedges are recognized immediately in the non-consolidated

statement of income.

(r) Stock Options

The Company has granted shares or share options to its employees and other parties. For equity-settled share-based payment transactions, the Company measures

the goods or services received, and the corresponding increase in equity as a capital adjustment at the fair value of the goods or services received, unless that fair

value cannot be estimated reliably. If the entity cannot estimate reliably the fair value of the goods or services received, the Company measures their value, and the

corresponding increase in equity, indirectly, by reference to the fair value of the equity instruments granted. If the fair value of the equity instruments cannot be

estimated reliably at the measurement date, the Company measures them at their intrinsic value and recognizes the goods or services received based on the

number of equity instruments that ultimately vest. For cash-settled share-based payment transactions, the Company measures the goods or services acquired and

the liability incurred at the fair value of the liability. Until the liability is settled, the Company remeasures the fair value of the liability at each reporting date and at the

date of settlement, with changes in fair value recognized in profit or loss for the period.

(s) Provision, Contingent Assets and Contingent Liabilities

Provisions are recognized when all of the following are met: (1) an entity has a present obligation as a result of a past event, (2) it is probable that an outflow of

resources embodying economic benefits will be required to settle the obligation, and (3) a reliable estimate can be made of the amount of the obligation. Where

the effect of the time value of money is material, a provision is recorded at the present value of the expenditures expected to be required to settle the obligation.

Where the expenditure required to settle a provision is expected to be reimbursed by another party, the reimbursement is recognized as a separate asset when,

and only when, it is virtually certain that reimbursement will be received if the Company settles the obligation. The expense relating to a provision is presented net

of the amount recognized for a reimbursement.

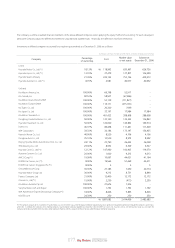

Provision for warranties

The Company generally provides warranty to the ultimate consumer for each product sold and accrues warranty expense at the time of sale based on the history of

actual claims. Also, the Company accrues potential expenses, which may occur due to any product liability suits or voluntary recall campaigns pending as of the

balance sheet date. The difference between the nominal value and present value of these is amortized using the effective interest method.