IBM 1999 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

International Business Machines Corporation

and Subsidiary Companies

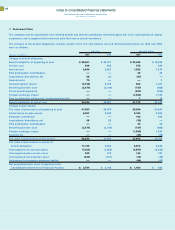

Five-Year Comparison of Selected Financial Data

(Dollars in millions except per share amounts)

For the year: 1999 1998 1997 1996 1995

Revenue $«87,548 $«81,667 $«78,508 $«75,947 $«71,940

Net income 7,712 6,328 6,093 5,429 4,178

Per share of common stock:

Assuming dilution 4.12 3.29* 3.00* 2.50* 1.76*

Basic 4.25 3.38* 3.09* 2.56* 1.81*

Cash dividends paid on common stock 859 814 763 686 572

Per share of common stock .47 .43* .3875* .325* .25*

Investment in plant, rental machines

and other property 5,959 6,520 6,793 5,883 4,744

Return on stockholders’ equity 39.0% 32.6% 29.7% 24.8% 18.5%

At end of year:

Total assets $«87,495 $«86,100 $«81,499 $«81,132 $«80,292

Net investment in plant, rental machines

and other property 17,590 19,631 18,347 17,407 16,579

Working capital 3,577 5,533 6,911 6,695 9,043

Total debt 28,354 29,413 26,926 22,829 21,629

Stockholders’ equity 20,511 19,433 19,816 21,628 22,423

*Adjusted to reflect a two-for-one stock split effective May 10, 1999.

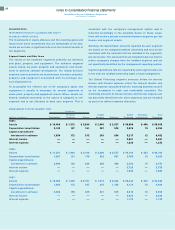

Selected Quarterly Data

(Dollars in millions except per share amounts and stock prices) Per Share of Common Stock

Earnings

Gross Net Assuming Stock Prices**

Revenue Profit Income Dilution Basic Dividends High Low

1999

First quarter $«20,317 $«««7,258 $«1,470 $«««.78 $«0.80 $«««.11* $«99.63* $«80.88*

Second quarter 21,905 8,224 2,391 1.28 1.32 .12 132.00 81.50*

Third quarter 21,144 7,564 1,762 .93 .97 .12 139.19 117.56

Fourth quarter 24,182 8,883 2,089 1.12 1.16 .12 123.25 89.00

Total $«87,548 $«31,929 $«7,712 $«4.12†$«4.25 $«««.47

1998

First quarter $«17,618 $«««6,450 $«1,036 $«««.53* $«««.54* $«««.10* $«54.19* $«47.81*

Second quarter 18,823 7,146 1,452 .75* .77* .11* 64.66* 51.66*

Third quarter 20,095 7,467 1,494 .78* .80* .11* 69.06* 55.38*

Fourth quarter 25,131 9,809 2,346 1.24* 1.27* .11* 94.97* 58.41*

Total $«81,667 $«30,872 $«6,328 $«3.29*†$«3.38* $«««.43*

*Adjusted to reflect a two-for-one stock split effective May 10, 1999.

†Earnings Per Share (EPS) in each quarter is computed using the weighted-average number of shares outstanding during that quarter while EPS for the full year

is computed using the weighted-average number of shares outstanding during the year. Thus, the sum of the four quarters’ EPS does not equal the full-year EPS.

**The stock prices reflect the high and low prices for IBM’s common stock on the New York Stock Exchange composite tape for the last two years.

94