IBM 1999 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

In December 1993, the company entered into a $10 billion

committed global credit facility to enhance the liquidity of funds.

This facility was amended in February 1997, and extended to

February 2002. As of December 31, 1999, $8,562 million was

unused and available.

The company managed assets of $273 million and $864 million

at December 31, 1999 and 1998, respectively, from the securiti-

zation of loans, leases and trade receivables. For additional

information, see note I, “Sale and Securitization of Receivables,”

on page 74.

The major rating agencies have continued their review of the

company’s financial condition. None of the agencies announced

a change in rating in 1999. Standard and Poor’s rates the com-

pany and its rated subsidiaries’ senior long-term debt as A+, the

commercial paper as A-1 and IBM’s preferred stock as A.

Moody’s Investors Service rates the senior long-term debt of

the company and its rated subsidiaries as A1, the commercial

paper as Prime-1, and the company’s preferred stock as “a1.”

Fitch Investors Service rates the company and its rated sub-

sidiaries’ senior long-term debt as AA-, commercial paper as

F-1+, and preferred stock as A+.

Duff & Phelps rates the company and its rated subsidiaries’

senior long-term debt as A+, commercial paper as Duff 1, and

the company’s preferred stock as A.

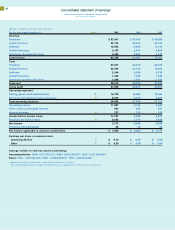

Cash Flows

The company’s cash flows from operating, investing and financ-

ing activities, as reflected in the Consolidated Statement of

Cash Flows on page 68, are summarized in the following table:

(Dollars in millions) 1999 1998 1997

Net cash provided from

(used in):

Operating activities $«10,111 $«««9,273 $«««8,865

Investing activities (1,669) (6,131) (6,155)

Financing activities (8,625) (4,993) (3,090)

Effect of exchange rate

changes on cash and

cash equivalents (149) 120 (201)

Net change in cash and

cash equivalents $«««««(332) $««(1,731) $«««÷(581)

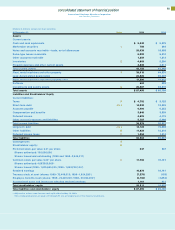

Working Capital

(Dollars in millions)

At December 31: 1999 1998

Current assets $«43,155 $«42,360

Current liabilities 39,578 36,827

Working capital $÷«3,577 $«««5,533

Current ratio 1.09:1 1.15:1

Current assets increased $795 million, driven primarily by

increases of $837 million in accounts receivable, $227 million in

prepaid expenses and other current assets and $63 million in

cash and cash equivalents and marketable securities, offset by

a decrease of $332 million in inventories. The increase in

accounts receivable is due to strong global financing activity in

the software and services businesses across all geographies.

The increase in prepaid expenses and other current assets is

due to increases in deferred tax assets from year-end 1998. The

increase in cash and cash equivalents and marketable securi-

ties resulted primarily from cash generated from operations

and the net proceeds from the sale of the company’s Global

Network, offset by stock repurchases, capital expenditures and

strategic acquisitions.

The company ended 1999 with inventories of $4,868 million, the

lowest level since 1983, due to continued focus on inventory

management process improvements, notably in Personal

Systems. These improvements increased the company’s

inventory turnover to 5.9 in 1999 from 5.3 in 1998.

Current liabilities increased $2,751 million from year-end 1998

with increases of $1,667 million in taxes payable, $325 million

in short-term debt and $759 million in other current liabilities.

The increase in other current liabilities resulted from increases

in accounts payable ($148 million), compensation and benefits

($310 million), and deferred income ($414 million), and a

$113 million decrease in other accrued expenses and liabilities.

The increase in taxes payable primarily reflects improvements

in the company’s results associated with the sale of the com-

pany’s Global Network to AT&T. Short-term debt increased to

support the growth of global financing assets. The increase in

other current liabilities was primarily related to deferred

income, mainly advanced billings for software.

59