IBM 1999 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

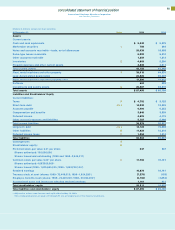

Investments

The company’s investments for plant, rental machines and other

property were $5,959 million for 1999, a decrease of $561 million

from 1998. The company continues to invest significantly in its

rapidly growing services business, primarily in the management

of customers’ information technology, and in manufacturing

capacity for HDDs and microelectronics.

In addition to software development expenses included in

research, development and engineering, the company capital-

ized $464 million of software costs during 1999, an increase of

$214 million from the 1998 period. The increase resulted pri-

marily from the adoption by the company as of January 1, 1999,

of the American Institute of Certified Public Accountants

Statement of Position (SOP) 98-1, “Accounting for the Costs of

Computer Software Developed or Obtained for Internal Use.”

The SOP requires the capitalization of internal use computer

software if certain criteria are met. The company amortizes the

capitalized costs over two years. Amortization of capitalized

software costs (both internal use and licensed programs) was

$426 million in 1999, a decline of $91 million from 1998.

Investments and sundry assets were $26,087 million at the end

of 1999, an increase of $2,577 million from 1998, primarily the

result of increases in prepaid pension assets, customer loan

receivables-not yet due, and alliance investments, which include

investments in high-growth-potential technology companies.

See note G, “Investments and Sundry Assets,” on page 73 for

additional information.

Debt and Equity

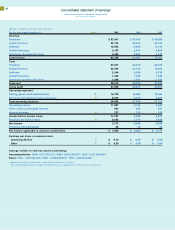

(Dollars in millions) 1999 1998

Non-global financing debt $÷«1,555 $«««1,659

Global financing debt 26,799 27,754

Total debt $«28,354 $«29,413

Stockholders’ equity $«20,511 $«19,433

Debt/ capitalization 58.0% 60.2%

EBITDA/ Interest expense 9x 8x

Non-global financing:

Debt/ capitalization 9.0% 9.9%

EBITDA/ Interest expense 19x 15x

Global financing debt/ equity 5.5:1 6.5:1

Because a financing business has a different capital structure

than a technology business, the company’s debt and key financial

ratios are calculated on both a global financing and non-global

financing basis.

Total debt decreased $1,059 million from year-end 1998 as debt

supporting the growth of global financing assets decreased $955

million and non-global financing debt decreased $104 million.

Stockholders’ equity increased $1,078 million to $20,511 million

at December 31, 1999, primarily due to the increase in retained

earnings and accumulated gains and losses not affecting

retained earnings, partially offset by the company’s ongoing

stock repurchase program. (See note N, “Stockholders’ Equity

Activity,” on pages 78 and 79.)

The ratio of non-global financing earnings before interest and

taxes plus depreciation and amortization (EBITDA) to non-

global financing interest expense, adjusted for future gross

minimum rental commitments, was 19x and 15x in 1999 and

1998, respectively. EBITDA is a useful indicator of the company’s

ability to service its debt.

Currency Rate Fluctuations

Changes in the relative values of non-U.S. currencies to the

U.S. dollar affect the company’s results. At December 31, 1999,

currency changes resulted in assets and liabilities denominated

in local currencies being translated into fewer dollars than at

year-end 1998. The currency rate changes had minimal effect

on 1999 revenue growth, but had an unfavorable effect on 1998

and 1997 revenue growth of approximately 2 percent and 5 per-

cent, respectively.

In high-inflation environments, translation adjustments are

reflected in period income, as required by SFAS No. 52, “Foreign

Currency Translation.” Generally, the company limits currency

risk in these countries by linking prices and contracts to U.S.

dollars, financing operations locally and entering into foreign

currency hedge contracts.

The company uses a variety of financial hedging instruments to

limit specific currency risks related to global financing transactions

and the repatriation of dividends and royalties. Further discussion

of currency and hedging appears in note L, “Financial Instruments,”

on pages 75 through 77.

60