IBM 1999 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

Immaterial Items

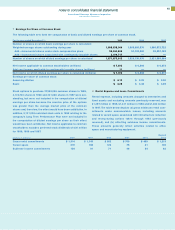

INVESTMENT IN EQUITY ALLIANCES AND EQUITY

ALLIANCES GAINS/ LOSSES

The investments in equity alliances and the resulting gains and

losses from these investments that are attributable to the seg-

ments do not have a significant effect on the financial results of

the segments.

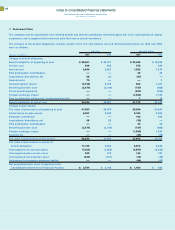

Segment Assets and Other Items

The assets of the hardware segments primarily are inventory

and plant, property and equipment. The software segment

assets mainly are plant, property and equipment, and invest-

ment in deferred software development. The Global Services

segment assets primarily are maintenance inventory and plant,

property and equipment associated with its strategic out-

sourcing business.

To accomplish the efficient use of the company’s space and

equipment, it usually is necessary for several segments to

share plant, property and equipment assets. Where assets are

shared, landlord ownership of the assets is assigned to one

segment and is not allocated to each user segment. This is

consistent with the company’s management system and is

reflected accordingly in the schedule below. In those cases,

there will not be a precise correlation between segment pre-tax

income and segment assets.

Similarly, the depreciation amounts reported by each segment

are based on the assigned landlord ownership and may not be

consistent with the amounts that are included in the segments’

pre-tax income. The amounts that are included in pre-tax income

reflect occupancy charges from the landlord segment and are

not specifically identified by the management reporting system.

Capital expenditures that are reported by each segment also are

in line with the landlord ownership basis of asset assignment.

The Global Financing segment amounts below for interest

income and interest expense reflect the interest income and

interest expense associated with the financing business as well

as the investment in cash and marketable securities. The

remaining amounts of interest income and interest expense are

not discretely identified to the other segments, but are included

as part of an indirect expense allocation.

92

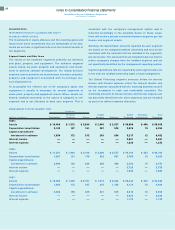

MANAGEMENT SYSTEM SEGMENT VIEW Hardware

Personal Global Global Enterprise Total

(Dollars in millions) Technology Systems Server Services Software Financing Investments Segments

1999:

Assets «$«10,409 $«1,372 $«2,846 $«2,060 $«2,527 $«39,686 $«408 $«59,308

Depreciation/ amortization 2,142 127 191 367 576 2,976 15 6,394

Capital expenditures/

investment in software 1,834 172 312 249 656 3,217 12 6,452

Interest income —————2,961—2,961

Interest expense —————1,232—1,232

1998:

Assets «$«11,251 $«1,464 $«2,106 $«2,236 $«2,577 $«40,109 $«363 $«60,106

Depreciation/ amortization 1,207 121 178 322 681 2,768 15 5,292

Capital expenditures/

investment in software 2,044 156 288 358 424 3,438 19 6,727

Interest income —————2,725—2,725

Interest expense —————1,252—1,252

1997 :

Assets «$«10,060 $«1,629 $«2,191 $«1,914 $«2,642 $«35,444 $«362 $«54,242

Depreciation/ amortization 1,092 112 167 315 1,132 2,170 10 4,998

Capital expenditures/

investment in software 2,028 195 235 361 515 3,615 16 6,965

Interest income —————2,639—2,639

Interest expense —————1,175—1,175