IBM 1999 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

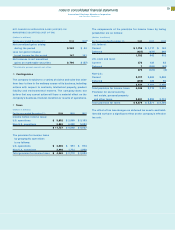

N Stockholders’ Equity Activity

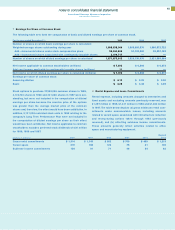

Stock Repurchases

From time to time, the Board of Directors authorizes the

company to repurchase IBM common stock. The company

repurchased 71,618,800 common shares at a cost of $7.3 bil-

lion and 114,768,200 common shares at a cost of $6.9 billion in

1999 and 1998, respectively. In 1999, the company did not retire

the shares it repurchased. The 1998 repurchases resulted in a

reduction of $28,498,409 in the stated capital (par value)

associated with common stock. In 1998, the company retired

the repurchased shares and restored them to the status of

authorized but unissued shares. In 1999 and 1998, the company

issued 906,829 and 774,564 shares, respectively, as a result of

exercises of employee stock options. At December 31, 1999,

approximately $2.5 billion of Board authorization for repur-

chases remained. The company plans to purchase shares on the

open market from time to time, depending on market conditions.

In 1995, the Board of Directors authorized the company to pur-

chase all of its outstanding Series A 7-1 ⁄2 percent preferred

stock. The company did not repurchase any shares in 1999.

During 1998, the company repurchased 51,250 shares at a cost

of $5.5 million. This resulted in a $512.50 ($.01 par value per

share) reduction in the stated capital associated with pre-

ferred stock as of December 31, 1998. The company retired the

repurchased shares and restored them to the status of authorized

but unissued shares. The company plans to purchase the

remaining outstanding shares on the open market and in private

transactions from time to time, depending on market conditions.

There were 2,546,011 shares outstanding at December 31,

1999 and 1998.

Employee Benefits Trust

Effective November 1, 1997, the company created an employee

benefits trust to which it contributed 20 million shares of treasury

stock. The company is authorized to instruct the trustee to sell

shares from time to time and to use proceeds from those sales,

and any dividends paid on the contributed stock, toward the

partial satisfaction of the company’s future obligations under

certain of its compensation and benefits plans. The shares held

in trust are not considered outstanding for purposes of calcu-

lating earnings per share until they are committed to be

released. The trustee will vote the shares in accordance with

its fiduciary duties. As of December 31, 1999 and 1998, the

company had not committed any shares to be released.

At December 31, 1998, the company adjusted its valuation of

the employee benefits trust to fair value. This adjustment

affected only line items within stockholders’ equity; it did not

affect total stockholders’ equity or net income.

78

Accumulated Gains and Losses Not Affecting Retained Earnings

Foreign Net Unrealized Total Gains and

Currency Gains (Losses) on Losses Not Affecting

(Dollars in millions) Items*Marketable Securities*Retained Earnings*

Beginning balance, January 1, 1997 $«2,401 $«168 $«2,569

Change for period (1,610) (60) (1,670)

Ending balance, December 31, 1997 791 108 899

Change for period 69 (57) 12

Ending balance, December 31, 1998 860 51 911

Change for period (546) 796 250

Ending balance, December 31, 1999 $÷÷314 $«847 $«1,161

*Net of tax.