IBM 1999 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

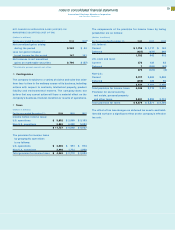

The significant components of activities that gave rise to

deferred tax assets and liabilities that are recorded on the

balance sheet were as follows:

DEFERRED TAX ASSETS

(Dollars in millions)

At December 31: 1999 1998

Employee benefits $«««3,737 $«««3,909

Alternative minimum tax credits 1,244 1,169

Bad debt, inventory and

warranty reserves 1,093 1,249

Infrastructure reduction charges 918 863

Capitalized research and development 880 913

Deferred income 870 686

General business credits 605 555

Foreign tax loss carryforwards 406 304

Equity alliances 377 387

Depreciation 326 201

State and local tax loss carryforwards 227 212

Intracompany sales and services 153 182

Other 2,763 2,614

Gross deferred tax assets 13,599 13,244

Less: Valuation allowance 647 488

Net deferred tax assets $«12,952 $«12,756

DEFERRED TAX LIABILITIES

(Dollars in millions)

At December 31: 1999 1998

Retirement benefits $«««3,092 $«««2,775

Sales-type leases 2,914 3,433

Depreciation 1,237 1,505

Software costs deferred 250 287

Other 2,058 1,841

Gross deferred tax liabilities $«««9,551 $«««9,841

The valuation allowance at December 31, 1999, principally applies

to certain state and local and foreign tax loss carryforwards

that, in the opinion of management, are more likely than not to

expire before the company can use them.

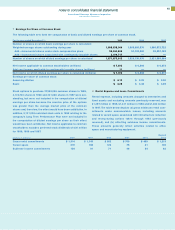

A reconciliation of the company’s effective tax rate to the statutory

U.S. federal tax rate is as follows:

For the year ended December 31: 1999 1998 1997

Statutory rate 35% 35% 35%

Foreign tax differential (2) (6) (3)

State and local 111

Valuation allowance

related items —(1) —

Other —1—

Effective rate 34% 30% 33%

For tax return purposes, the company has available tax credit

carryforwards of approximately $1,919 million, of which $1,244 mil-

lion have an indefinite carryforward period, $199 million expire

in 2004 and the remainder thereafter. The company also has

state and local and foreign tax loss carryforwards, the tax effect

of which is $633 million. Most of these carryforwards are avail-

able for 10 years or have an indefinite carryforward period.

Undistributed earnings of non-U.S. subsidiaries included in

consolidated retained earnings were $14,900 million at

December 31, 1999, $13,165 million at December 31, 1998, and

$12,511 million at December 31, 1997. These earnings, which

reflect full provision for non-U.S. income taxes, are indefinitely

reinvested in non-U.S. operations or will be remitted substan-

tially free of additional tax.

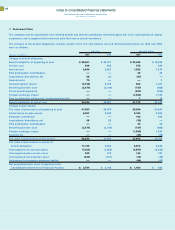

Q Selling and Advertising

Selling and advertising expense is charged against income as

incurred. Advertising expense, which includes media, agency

and promotional expenses, was $1,758 million, $1,681 million

and $1,708 million in 1999, 1998 and 1997, respectively.

80