IBM 1999 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

82

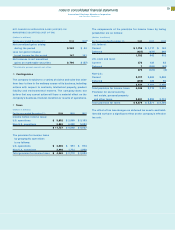

The following table identifies the significant components of the pre-tax charge related to the 1999 actions as well as the after-tax

charges and the effect on earnings per share assuming dilution; the investments and other asset write-downs in 1999; and the lia-

bility as of December 31, 1999:

Effect on

Earnings Investments

Total per Share– and Other Liability

Pre-Tax After-Tax Assuming Asset Created Liability as of

(Dollars in millions except per share amounts) Charges*Charges Dilution Write-Downs in 1999 Dec. 31, 1999

Technology Group

MD Actions:

DRAM

Equipment(1) $÷««662 $««««603 $«.32 $««««662 $«««— $«««—

Employee Terminations(2) 167 167 .09 — 167 149

Dominion Investment(3) 171 104 .05 171 — —

MiCRUS Investment(4) 152 92 .05 — 152 152

SSD Actions:

Equipment(5) 337 277 .15 337 — —

Employee Terminations(6) 23 14 .01 — 23 7

NHD Action:

Inventory Write-downs and

Contract Cancellations(7) 178 109 .06 178 — —

Total 1999 Actions $«1,690 $«1,366 $«.73 $«1,348 $«342 $«308

*With the exception of NHD inventory write-downs, all charges were recorded in Selling, general and administrative expense. NHD inventory write-downs were

recorded in Hardware cost.

(1) Represents (a) the difference between net book value and fair value of assets that were contributed to a joint venture, (b) the book value of assets that were

idled as a result of the MD actions and that were scrapped and (c) the difference between the net book value and the appraised fair value of test equipment

subject to sale-leaseback agreements.

(2) Workforce reductions that affect approximately 790 employees (455 direct manufacturing and 335 indirect manufacturing) in France. The workforce reductions

are expected to be substantially completed by the end of the first quarter of 2000.

(3) Write-off of investment in joint venture at the signing of the agreement with Toshiba Corporation.

(4) Acquisition of minority interest in MiCRUS and charges for equipment leasehold cancellation liabilities and lease rental payments for idle equipment.

(5) Represents (a) the book value of assets that were idled as a result of the SSD actions and scrapped, (b) write-downs to fair value of equipment under contract

for sale and delivery by December 31, 1999, and March 31, 2000, and (c) the difference between the net book value and the appraised fair value of equipment

subject to sale-leaseback agreements.

(6) Workforce reductions that affect approximately 900 employees (780 direct manufacturing and 120 indirect manufacturing) in the United States. There are 210

terminations remaining in the first half of 2000.

(7) Write-down to net realizable value of inventory of router and switch products ($144 million) and contract cancellation fees ($34 million) related to deterioration

in demand for router and switch products.

Change in Estimate

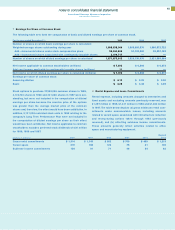

As a result of a change in estimate of the useful life of personal

computers (PCs) from five years to three years, the company

recognized a charge in the second quarter of 1999 of $404 mil-

lion ($241 million after tax, $.13 per diluted common share). In

the second quarter, the company wrote off the net book value

of PCs that were 3 years or older and, therefore, had no remain-

ing useful life. The remaining book value of the assets will be

depreciated over the remaining new useful life. The net effect

on future operations is expected to be minimal as the increased

depreciation due to the shorter life will be offset by the lower

depreciable base attributable to the write-off of PCs older than

three years.

S Research, Development and Engineering

Research, development and engineering expense was $5,273

million in 1999, $5,046 million in 1998 and $4,877 million in 1997.

Expenses for product-related engineering included in these

amounts were $698 million, $580 million and $570 million in

1999, 1998 and 1997, respectively.

The company had expenses of $4,575 million in 1999, $4,466

million in 1998 and $4,307 million in 1997 for basic scientific

research and the application of scientific advances to the devel-

opment of new and improved products and their uses. Of these

amounts, software-related expenses were $2,036 million,

$2,086 million and $2,016 million in 1999, 1998 and 1997, respec-

tively. Included in the expense each year are charges for

acquired in-process research and development. See note D,

“Acquisitions/ Divestitures” on pages 72 and 73 for further infor-

mation about that expense.