IBM 1999 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

Integrated Technology Services offer customers a single IT

partner to manage multi-vendor IT systems’ complexity in today’s

e-business environment including traditional offerings like

Product Support, Business Recovery Services, Site and

Connectivity Services, and Systems Management and Networking

Services. Learning Services supports the three primary lines

of business and help customers design, develop and deploy

curricula to educate their employees. The Global Services

segment is uniquely suited to integrate the full range of the

company’s and key industry participants’ capabilities, including

hardware, software, services and research.

The Software segment delivers operating systems for the com-

pany’s servers and e-business enabling software (middleware)

for IBM and non-IBM platforms. The company has reorganized

its e-business offerings to align with key customer opportunity

areas —transformation and integration, leveraging information,

organizational effectiveness and managing technology. In

addition to its own development, product and marketing effort,

the segment supports more than 35,000 Independent Software

Vendors to ensure that the company’s software and hardware

offerings are included in those partners’ solutions.

The Global Financing segment is the world’s largest provider of

financing services for information technology (IT). The segment

provides lease and loan financing that enables the company’s

customers to acquire complete IT and e-business solutions—

hardware, software and services—provided by the company

and its business partners. Special focus is placed on the financ-

ing needs of small and medium businesses, and the emerging

financing needs of NetGen companies. Global Financing, as a

reliable source of capital for the distribution channel, also

provides the company’s business partners with customized

commercial financing for inventory, accounts receivable, term

loans and acquisitions, helping them manage their cash flow,

invest in infrastructure and grow their business.

The Enterprise Investments segment provides industry specific

information technology solutions, supporting the hardware,

software and services segments of the company. The segment

develops unique products designed to meet specific market-

place requirements and to complement the company’s overall

portfolio of products.

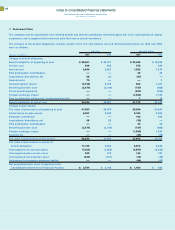

Segment revenue and pre-tax income include transactions

between the segments that are intended to reflect an arm’s-

length transfer at the best price available for comparable external

customers. Specifically, semiconductors and disk drives are

sourced internally from the Technology segment for use in the

manufacture of the Server segment and Personal Systems

segment products. Technology, hardware and software that are

used by the Global Services segment in outsourcing engage-

ments are sourced internally from the Technology, Server,

Personal Systems and Software segments. For the internal use

of information technology services, the Global Services seg-

ment recovers cost as well as a reasonable fee reflecting the

arm’s-length value of providing the services. The Global Services

segment enters into arm’s-length leases at prices equivalent to

market rates with the Global Financing segment to facilitate the

acquisition of equipment used in outsourcing engagements.

All internal transaction prices are reviewed and reset annually

if appropriate.

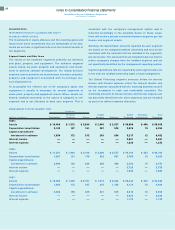

The company extensively uses shared-staff concepts to realize

economies of scale and efficient use of resources. Thus, a sig-

nificant amount of expense is shared by all of the company’s

segments. This expense represents sales coverage, marketing

and support functions such as Accounting, Treasury, Procure-

ment, Legal, Human Resources, and Billing and Collections.

Where practical, shared expenses are allocated based on

measurable drivers of expense; e.g., Human Resources costs

are allocated on headcount while account coverage expenses

are allocated on a revenue mix that reflects the company’s

sales commission plan. When a clear and measurable driver

cannot be identified, shared expenses are allocated on a finan-

cial basis that is consistent with the company’s management

system; e.g., image advertising is allocated based on the gross

profit of the segments. The unallocated corporate expenses

arising from certain acquisitions, indirect infrastructure reduc-

tions, certain intellectual property income and currency

exchange gains and losses are recorded in net income but are

not allocated to the segments.

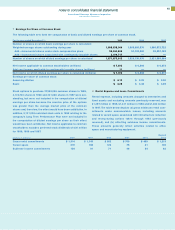

The following tables reflect the results of the segments consis-

tent with the company’s management system. These results are

not necessarily a depiction that is in conformity with generally

accepted accounting principles; e.g., employee retirement plan

costs are developed using actuarial assumptions on a country-

by-country basis and allocated to the segments on headcount.

A different result could be arrived at for any segment using

actuarial assumptions that are unique to the segment. Perform-

ance measurement is based on income before income taxes

(pre-tax income). These results are used, in part, by management,

both in evaluating the performance of, and in allocating resources

to, each of the segments.

90