IBM 1999 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

either assets or liabilities in the statement of financial position

and to measure those instruments at fair value. Additionally, the

fair value adjustments will affect either stockholders’ equity or

net income depending on whether the derivative instrument

qualifies as a hedge for accounting purposes and, if so, the

nature of the hedging activity. The company will adopt this stan-

dard as of January 1, 2001. Management does not expect the

adoption to have a material effect on the company’s results of

operations; however, the effect on the company’s financial posi-

tion depends on the fair values of the company’s derivatives

and related financial instruments at the date of adoption.

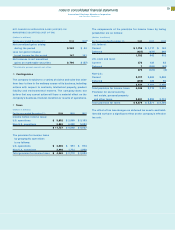

C Common Stock Split

On January 26, 1999, the company’s Board of Directors approved

a two-for-one stock split effective May 10, 1999. On April 27, 1999,

the stockholders of the company approved amendments to the

Certificate of Incorporation to increase the number of authorized

shares of common stock from 1,875 million to 4,687.5 million,

which was required to effect that stock split. In addition, the

amendment reduced the par value of the common shares from

$.50 to $.20 per share. Common stockholders of record at the

close of business on May 10, 1999, received one additional

share for each share held. All share and per share data presented

in the Consolidated Financial Statements and notes of this Annual

Report reflect the two-for-one stock split.

D Acquisitions/ Divestitures

Acquisitions

In 1999, the company completed 17 acquisitions at a cost of

approximately $1.5 billion. Three of the major acquisitions for

the year are detailed in the following discussion.

On September 24, 1999, the company acquired all of the

outstanding capital stock of Sequent Computer Systems, Inc.

(Sequent) for approximately $828 million. Sequent was an

acknowledged leader in systems based on NUMA (non-uniform

memory access) architecture.

On September 29, 1999, the company acquired all of the

outstanding stock of Mylex Corporation (Mylex) for approximately

$259 million. Mylex was a leading developer of technology for

moving, storing, protecting and managing data in desktop and

networked environments.

On September 27, 1999, the company acquired DASCOM, Inc.

(DASCOM), an industry leader in Web-based and enterprise-

security technology, for approximately $115 million.

The company accounted for each acquisition as a purchase

transaction. The effects of these acquisitions on the company’s

Consolidated Financial Statements were not material. Hence, the

company has not provided pro forma financial statements as if

the companies had combined at the beginning of the current

period or the immediately preceding period.

The company engaged a nationally recognized independent

appraisal firm to express an opinion on the fair value of the net

assets that the company acquired to serve as a basis for the

following allocation of the purchase price.

(Dollars in millions) Sequent Mylex DASCOM

Purchase price $«828 $«259 $«115

Tangible net assets (liabilities) 382 67 (17)

Identifiable intangible assets 187 35 13

Current technology 87 26 19

Goodwill 183 145 92

In-process research

and development 85 7 19

Deferred tax liabilities

related to identifiable

intangible assets «(96) «««««(21) ÷÷÷(11)

The tangible net assets comprise primarily cash, accounts

receivable, land, buildings and leasehold improvements. The iden-

tifiable intangible assets comprise primarily patents, trademarks,

customer lists, assembled workforce, employee agreements

and leasehold interests. The identifiable intangible assets and

goodwill will be amortized on a straight-line basis over a five-

year period.

In connection with the acquisitions of Sequent, Mylex and

DASCOM, the company recorded a pre-tax charge for research,

development and engineering of $111 million ($111 million

after tax, or $.06 per diluted common share) for acquired in-

process research and development (IPR&D). At the date of each

acquisition, the IPR&Dprojects had not yet reached technolog-

ical feasibility and had no alternative future uses. The value of

the IPR&Dreflects the relative value and contribution of the

acquired research and development to the company’s existing

research or product lines.

72