IBM 1999 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

77

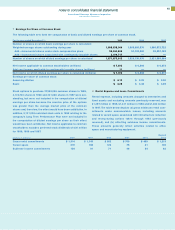

The company also uses derivatives to limit its exposure to loss

resulting primarily from fluctuations in foreign currency exchange

rates on anticipated cash transactions among foreign sub-

sidiaries and with the parent company. The company receives

significant intracompany royalties and net payments for goods

and services from its non-U.S. subsidiaries. In anticipation of

these foreign currency flows, and in view of the volatility of the

currency markets, the company selectively employs foreign

currency derivatives to manage its currency risk. The terms of

these instruments generally are less than eighteen months.

For purchased options that hedge qualifying anticipated

transactions, gains and losses are deferred and recognized in

net income in the same period that the underlying transaction

occurs, expires or otherwise is terminated. At December 31,

1999 and 1998, there were no material deferred gains or losses.

The premiums associated with entering into these option

contracts generally are amortized over the life of the options

and are not material to the company’s results. Unamortized

premiums are recorded in prepaid assets. Gains and losses on

purchased options that hedge anticipated transactions that do

not qualify for hedge accounting, and on written options, are

recorded in earnings as they occur and are not material to the

company’s results.

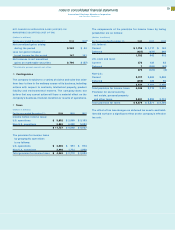

M Other Liabilities and Environmental Remediation

Other liabilities principally comprises accruals for nonpension

postretirement benefits for U.S. employees ($6,392 million) and

nonpension postretirement benefits, indemnity and retirement

plan reserves for non-U.S. employees ($1,028 million). More

detailed discussion of these liabilities appears in note X, “Non-

pension Postretirement Benefits,” on pages 88 and 89, and note

W, “Retirement Plans,” on pages 86 through 88.

Also included in other liabilities are non-current liabilities

associated with infrastructure reduction and restructuring

actions taken through 1993. Other liabilities includes $659 mil-

lion for postemployment preretirement accruals and $503 million

(net of sublease receipts) for accruals for leased space that the

company vacated.

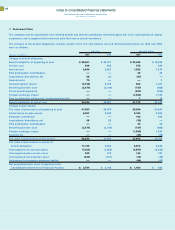

The company employs extensive internal environmental protec-

tion programs that primarily are preventive in nature. The cost

of these ongoing programs is recorded as incurred.

The company continues to participate in environmental assess-

ments and cleanups at a number of locations, including operating

facilities, previously owned facilities and Superfund sites. The

company accrues for all known environmental liabilities when

it becomes probable that the company will incur clean-up

costs and those costs can reasonably be estimated. In addition,

estimated environmental costs that are associated with post-

closure activities (for example, the removal and restoration of

chemical storage facilities and monitoring) are accrued when

the decision is made to close a facility. The total amounts accrued,

which do not reflect actual or anticipated insurance recoveries,

were $240 million and $238 million at December 31, 1999 and

1998, respectively.

The amounts accrued do not cover sites that are in the preliminary

stages of investigation; that is, for which neither the company’s

percentage of responsibility nor the extent of cleanup required

has been identified. Estimated environmental costs are not

expected to materially affect the financial position or results of

the company’s operations in future periods. However, estimates

of future costs are subject to change due to protracted cleanup

periods and changing environmental remediation regulations.