IBM 1999 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

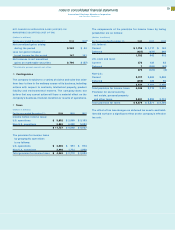

The benefit obligation was determined by applying the terms of

medical, dental and life insurance plans, including the effects of

established maximums on covered costs, together with relevant

actuarial assumptions. These actuarial assumptions include a

projected healthcare cost trend rate of 6 percent.

The net periodic postretirement benefit cost for the U.S.

plan for the years ended December 31 included the following

components:

(Dollars in millions) 1999 1998 1997

Service cost $«««48 $«««42 $«««32

Interest cost 424 427 455

Expected return on plan assets (6) (5) (15)

Net amortization of

unrecognized net actuarial

losses and prior service costs (124) (133) (119)

Net periodic postretirement

benefit cost $«342 $«331 $«353

WEIGHTED-AVERAGE ASSUMPTIONS AS OF DECEMBER 31:

Discount rate 7.75% 6.5% 7.0%

Expected return

on plan assets 5.0% 5.0% 5.0%

The plan assets primarily comprise short-term fixed income

investments.

Certain of the company’s non-U.S. subsidiaries have similar

plans for retirees. However, most of the retirees outside the

United States are covered by government-sponsored and

administered programs. The obligations and cost of these pro-

grams are not significant to the company.

A one-percentage-point change in the assumed healthcare

cost trend rate would have the following effects as of Decem-

ber 31, 1999:

One-Percentage- One-Percentage-

(Dollars in millions) Point Increase Point Decrease

Effect on total service and

interest cost $«««7 $«««««(9))

Effect on postretirement benefit

obligation $«95 $«(120)

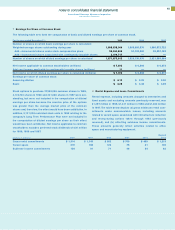

Y Segment Information

IBM uses advanced information technology to provide customer

solutions. The company operates primarily in a single industry

using several segments that create value by offering a variety of

solutions that include, either singularly or in some combination,

technologies, systems, products, services, software and financing.

Organizationally, the company’s major operations comprise three

hardware product segments—Technology, Personal Systems

and Server; a Global Services segment; a Software segment; a

Global Financing segment and an Enterprise Investment seg-

ment. The segments are determined based on several factors,

including customer base, homogeneity of products, technology

and delivery channels.

The Technology segment produces peripheral equipment for

use in general-purpose computer systems, including storage

and networking devices, advanced function printers and display

devices. In addition, the segment provides components such

as semiconductors and HDDs for use in the company’s products

and for sale to original equipment manufacturers (OEM). Major

business units include Storage Systems, Microelectronics, Printer

Systems and Networking Hardware.

The Personal Systems segment produces general-purpose

computer systems, including some system and consumer soft-

ware, that operate applications for use by one user at a time

(personal computer clients) or as servers, and display devices.

Major brands include the Aptiva home

PC

s, IntelliStation work-

stations, Netfinity servers,

PC

300 commercial desktop and

ThinkPad mobile systems. These products are sold directly by

the company and through reseller and retail channels.

The Server segment produces powerful multi-purpose computer

systems that operate many open-network-based applications

and are used simultaneously by multiple users. They perform

high-volume transaction processing and serve data to personal

systems and other end-user devices. The servers are the engines

behind the bulk of electronic business transactions, including

e-commerce. Brands include S/ 390, AS/ 400, RS/ 6000 and

NUMA-Q. The segment’s products are sold directly by the com-

pany and through business partner relationships.

The Global Services segment is the world’s largest and most

versatile information technology services provider, supporting

computer hardware and software products and providing pro-

fessional services to help customers of all sizes realize the full

value of information technology. The segment provides value

through three primary lines of business: Strategic Outsourcing

Services; Business Innovation Services; and Integrated Technol-

ogy Services. Strategic Outsourcing Services create business

value through long-term strategic partnerships with customers

by taking on responsibility for their processes and systems.

Business Innovation Services (formerly Systems Integration

and Consulting) provide business/ industry consulting and end-

to-end e-business implementation of offerings like Supply

Chain Management, Customer Relationship Management,

Enterprise Resource Planning and Business Intelligence.

89