IBM 1999 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

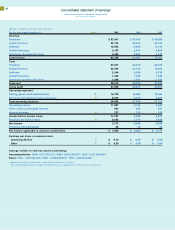

Total Run Out of 1999 Balance

2003 and

(Dollars in millions) 1997 1998 1999 2000 2001 2002 beyond

Sales-type leases $««««563 $««««685 $÷÷737 $«209 $«301 $«198 $«29

Operating leases 701 731 609 319 197 87 6

Total residual value $«1,264 $«1,416 $«1,346 $«528 $«498 $«285 $«35

management discussion

International Business Machines Corporation

and Subsidiary Companies

Foreign Currency Exchange Rate Risk: As of December 31, 1999, a

10 percent decrease or increase in the levels of foreign currency

exchange rates against the U.S. dollar with all other variables

held constant would result in a decrease in the fair value of the

company’s financial instruments of $1,319 million or an increase

in the fair value of the company’s financial instruments of

$1,340 million, respectively, compared with a decrease of

$597 million or an increase of $855 million, respectively, as of

December 31, 1998. The change in the relative sensitivity of the

fair market value of the company’s financial instrument portfolio

to the level of foreign currency exchange rates primarily is driven

by an increase in the overall level of net foreign investment

hedging activity as well as by an increase in the use of foreign

currency forwards in lieu of foreign currency options to hedge

the company’s various foreign currency exposures in accordance

with the company’s established risk management practices.

As the effect of offsetting changes in the fair market value of

the company’s net foreign investments are not included in the

sensitivity model, the results of the analysis do not indicate an

increase in the company’s actual exposure to foreign currency

exchange rate risk.

Financing Risks

Global financing is an integral part of the company’s total world-

wide offerings. Inherent in global financing are certain risks,

including credit, interest rate, currency and residual value. The

company manages credit risk through comprehensive credit

evaluations and pricing practices. To manage the risks associ-

ated with an uncertain interest rate environment, the company

pursues a funding strategy of substantially matching the terms of

its debt with the terms of its assets. Currency risks are managed

by denominating liabilities in the same currency as the assets.

Residual value risk is managed by developing projections of

future equipment values at lease inception, reevaluating these

projections periodically, and effectively deploying remarketing

capabilities to recover residual values and potentially earn a profit.

Remarketing efforts consistently have generated profits. The

following table depicts an approximation of the unguaranteed

residual value maturities for the company’s sales-type leases, as

well as a projection of the remaining net book value of machines

on operating leases at the end of the lease terms as of Dec-

ember 31, 1997, 1998 and 1999. The following table excludes

approximately $34 million of estimated residual value associated

with non-information technology equipment.

62