IBM 1999 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At this point last year, the only thing we knew for

certain was that the coming year would be unlike any

other. We faced some big unknowns – economic

crises in Asia and Latin America, the Euro conversion

and, of course, Y2K. Underlying it all, making the

uncertainties even more uncertain, was the tectonic

plate shift of e-business.

As it played out, 1999 was, indeed, a roller coaster

for IBM. The first half saw remarkable growth for our

company, but in the second half, Y2K hit us hard.

Many of our biggest customers locked down their

systems and their spending, and because IBM’s

customer base contains so many of the world’s

leading businesses, government agencies and

financial institutions – the very enterprises most

at risk from Y2K – our sales suffered accordingly.

Even so, when you average out the highs

and lows, 1999 was a good year for IBM. For the

fifth straight year, we reported record revenue –

$87.5 billion, up 7percent over 1998. Our earnings

rose to $7.7 billion, a 22-percent increase, resulting

in another new record in earnings per diluted

common share. Customer satisfaction achieved

its highest level in a decade.

After making substantial investments – $5.8 billion

on research and development, $6billion on capital

expenditures and $1.5 billion on acquisitions

that strengthened our business portfolio – we had

enough cash to buy back $7. 3 billion of common

shares and to increase our dividend to shareholders.

Our market value, probably the most important

measure of progress to investors, grew $24 billion

in 1999, and has increased by nearly $170 billion

in the past seven years.

Those are all good numbers, but not good enough.

After building some real momentum over the previous

two years, IBMers found the last two quarters of 1999

frustrating in the extreme. Some outside the company

say it was a wake-up call. I say it was a starting gun,

because now, the real race begins.

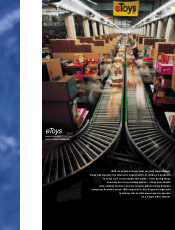

The dot-coms, it seems, are taking over. You

can’t chart future strategy, execute a transaction,

invest money, even read a paper or magazine

or watch TV without, somewhere in the process,

bumping into dot-coms and, behind them, the

whole world of e-business.

Some find all this energizing, some annoying,

but everyone’s paying attention. It’s the first question

I get from any IBM customer in almost any part of

the world: “What must I do to survive and win in this

new world?” In fact, at the moment, it’s just about

the only question I get.

The fact is, 1999 was the year e-business and the

global Internet economy came of age. It was a tidal

wave, sweeping everything before it, driving new

levels of megamerger activity, carrying thousands

of entirely new businesses to unprecedented levels

of wealth (much of it probably unsustainable),

submerging almost as many others, and rearranging

the landscape of commerce.

One conservative estimate is that the e-business

opportunity will approach $600 billion by 2003, and it

could well be even larger than that. While the overall

information technology (I/T) industry grows at around

11 percent, the e-business portion is growing much

faster – at around 22 percent.

All that adds up to a tremendous opportunity

for IBM. I’m not talking here about the pent-up

demand that will be released as Y2K lockdowns are

unlocked. I’m talking about the fact that customers

are investing heavily in new e-business applications

and solutions. We expect 2000 to be a good

year for our company. However, we aren’t taking

anything for granted. We know how open the field

Dear fellow investor,

03