IBM 1999 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

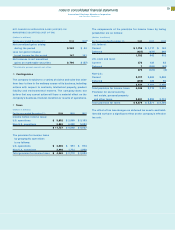

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

Financial Instruments

In the normal course of business, the company uses a variety of

derivative financial instruments to manage currency exchange

rate and interest rate risk. To qualify for hedge accounting, the

company requires that the derivative instruments that are used

for risk management purposes effectively reduce the risk expo-

sure that they are designed to hedge. For instruments that are

associated with the hedge of an anticipated transaction, hedge

effectiveness criteria also require that it be probable that the

underlying transaction will occur. Instruments that meet these

hedging criteria are formally designated as hedges at the

inception of the contract. When the terms of an underlying

hedged item or transaction are modified, or when the underly-

ing hedged item ceases to exist, all changes in the fair value of

the risk management instrument are recognized in income

each period until the instrument matures. Those risk manage-

ment instruments that do not meet the hedging criteria are

accounted for at fair value, and changes in fair value are recog-

nized immediately in net income. Refer to note L, “Financial

Instruments,” on pages 75 through 77 for descriptions of the

major classes of derivative financial instruments used by the

company, including the specific methods that the company

uses to account for them.

In determining the fair value of its derivative and non-derivative

financial instruments, the company uses a variety of methods

and assumptions that are based on market conditions and risks

existing at each balance sheet date. For the majority of financial

instruments including most derivatives, long-term investments

and long-term debt, standard market conventions and tech-

niques such as estimated discounted value of future cash

flows, option pricing models, replacement cost and termination

cost are used to determine fair value. Quoted market prices or

dealer quotes for the same or similar instruments are used for

the remaining financial instruments.

Cash Equivalents

All highly-liquid investments with a maturity of three months or

less at date of purchase are carried at fair value and considered

to be cash equivalents.

Marketable Securities

Marketable securities included in current assets represent

securities with a maturity of less than one year. The company’s

policy is to invest in primarily high-grade marketable securities.

The company’s marketable securities are considered available

for sale and are reported at fair value with changes in unreal-

ized gains and losses, net of applicable taxes, recorded in

Accumulated gains and losses not affecting retained earnings

within stockholders’ equity. Realized gains and losses are calcu-

lated based on the specific identification method.

Inventories

Raw materials, work in process and finished goods are stated

at the lower of average cost or net realizable value.

Depreciation

Plant, rental machines (computer equipment that is used

internally, subject to an operating lease or as part of strategic

outsourcing contracts) and other property are carried at cost

and depreciated over their estimated useful lives using the

straight-line method.

The estimated useful lives of depreciable properties generally

are as follows: buildings, 50 years; building equipment, 20 years;

land improvements, 20 years; plant, laboratory and office equip-

ment, 2 to 15 years; and computer equipment, 1.5 to 5 years.

Software

Costs that are related to the conceptual formulation and design

of licensed programs are expensed as research and develop-

ment. Also, for licensed programs, the company capitalizes

costs to produce the finished product that are incurred after

technological feasibility is established. The annual amortization

of the capitalized amounts is the greater of the amount com-

puted based on the estimated revenue distribution over the

products’ revenue-producing lives, or the straight-line method,

and is applied over periods ranging up to three years. The

company performs periodic reviews to ensure that unamortized

program costs remain recoverable from future revenue. The

company charges costs to support or service licensed programs

against income as they are incurred.

The company capitalizes certain costs that are incurred to

purchase or to create and implement internal use computer

software, which include software coding, installation, testing

and data conversion. Capitalized costs are amortized on a

straight-line basis over two years.

Retirement Plans and Nonpension Postretirement Benefits

Current service costs of retirement plans and postretirement

healthcare and life insurance benefits are accrued in the period.

Prior service costs that result from amendments to the plans

are amortized over the average remaining service period of the

employees expected to receive benefits. Unrecognized net

gains and losses that exceed ten percent of the greater of the

projected benefit obligation or the market-related value of plan

assets are amortized to service cost over the average remain-

ing service life of employees expected to receive benefits. See

note W, “Retirement Plans,” on pages 86 through 88 and note X,

“Nonpension Postretirement Benefits,” on pages 88 and 89 for

further discussion.

70