IBM 1999 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

87

U.S. Plan

U.S. regular, full-time and part-time employees are covered by

a noncontributory plan that is funded by company contribu-

tions to an irrevocable trust fund, which is held for the sole

benefit of participants.

Effective July 1, 1999, IBM converted to a new formula, the

Personal Pension Account (PPA), for determining pension benefits

for most of its employees. Under the PPA, retirement benefits

are credited to each employee’s cash balance account monthly

based on a percentage of the employee’s pensionable com-

pensation. Employees who were retirement eligible or within

five years of retirement eligibility with at least one year of service,

or who were at least forty years of age with at least ten years of

service as of June 30, 1999, could elect to participate in the PPA

or to have their service and earnings credit accrue under the

preexisting benefit formula. Benefits become vested on the com-

pletion of five years of service under either formula.

The number of individuals who were receiving benefits at Decem-

ber 31, 1999 and 1998, was 124,175 and 116,685, respectively.

Non-U.S. Plans

Most subsidiaries and branches outside the U.S. have retire-

ment plans that cover substantially all regular employees, under

which the company deposits funds under various fiduciary-type

arrangements, purchases annuities under group contracts or

provides reserves. Retirement benefits are based on years of

service and the employee’s compensation, generally during a

fixed number of years immediately before retirement. The ranges

of assumptions that are used for the non-U.S. plans reflect the

different economic environments within various countries.

U.S. Supplemental Executive Retention Plan

The company also has a non-qualified U.S. Supplemental

Executive Retention Plan (SERP). The SERP, which is unfunded,

provides defined pension benefits outside the IBM Retirement

Plan to eligible executives based on average earnings, years of

service and age at retirement. Effective July 1, 1999, the company

adopted the Supplemental Executive Retention Plan (which

replaces the previous Supplemental Executive Retirement

Plan). Some participants of the pre-existing SERP still will be

eligible for benefits under that plan, but will not be eligible for

the new plan. At December 31, 1999 and 1998, the projected

benefit obligation was $149 million and $178 million, respec-

tively, and the amounts included in the Consolidated Statement

of Financial Position were pension liabilities of $109 million and

$81 million, respectively.

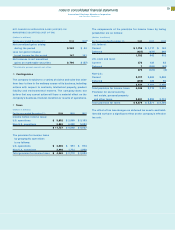

WEIGHTED-AVERAGE ASSUMPTIONS AS OF DECEMBER 31:

U.S. Plan Non-U.S. Plans

1999 1998 1997 1999 1998 1997

Discount rate 7.75% 6.5% 7.0% 4.5–7.3% 4.5–7.5% 4.5–7.5%

Expected return on plan assets 9.5% 9.5% 9.5% 6.0–10.5% 6.5-–10.0% 6.0–9.5%

Rate of compensation increase 6.0% 5.0% 5.0% 2.6–6.1% 2.7–6.1% 2.6–6.1%

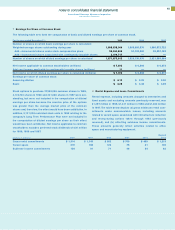

COST OF THE DEFINED BENEFIT PLANS:

U.S. Plan Non-U.S. Plans

(Dollars in millions) 1999 1998 1997 1999 1998 1997

Service cost $«««566 $«««532 $«««397 $«««475 $«««399 $«««366

Interest cost 2,404 2,261 2,215 1,282 1,213 1,182

Expected return on plan assets (3,463) (3,123) (2,907) (1,937) (1,739) (1,457)

Net amortization of unrecognized net actuarial

gains, net transition asset and prior service costs (145) (124) (125) 42 21 15

Settlement (gains)/ losses ——— (23) 10 (63)

Net periodic pension (benefit) cost—U.S. Plan

and material non-U.S. Plans $÷(638) $÷(454) $÷(420) $÷(161) $««÷(96) $«««÷43

Total net periodic pension (benefit) cost for all

non-U.S. Plans $««(124) $««««(42) $«««÷50

Cost of defined contribution plans $÷«275 $«««258 $«««236 $÷«131 $÷÷«90 $÷÷«64

Cost of complementary defined benefits $«««««38 $÷«««34 $÷«««33

Cost of U.S. Supplemental Executive

Retention Plan $÷÷«30 $÷«««25 $÷«««20