IBM 1999 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

74

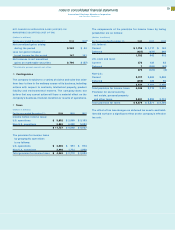

H Lines of Credit

The company maintains a $10.0 billion global credit facility. The

company’s other committed and uncommitted lines of credit

were $5.5 billion and $5.2 billion at December 31, 1999 and

1998, respectively. Interest rates and other terms of borrowing

under these lines of credit vary from country to country depend-

ing on local market conditions at the time of the borrowing.

(Dollars in billions)

At December 31: 1999 1998

Unused Lines

From the global credit facility $«««8.6 $«««8.8

From other committed and

uncommitted lines 4.5 4.3

Total unused lines of credit $«13.1 $«13.1

I Sale and Securitization of Receivables

The company manages assets of $273 million and $864 million

from the securitization of loans, leases and trade receivables, at

year-end 1999 and 1998, respectively. The company received

cash proceeds of $1,311 million and $2,425 million in 1999 and

1998, respectively, from the sale and securitization of these

receivables and assets. No significant gain or loss resulted from

these transactions. The company expects recourse amounts

associated with the aforementioned sale and securitization

activities to be minimal, and has adequate reserves to cover

potential losses.

J Debt

Short-term debt

(Dollars in millions)

At December 31: 1999 1998

Commercial paper $«««5,074 $«««4,885

Short-term loans 3,351 6,370

Long-term debt: Current maturities 5,805 2,650

Total $«14,230 $«13,905

The weighted-average interest rates for commercial paper at

December 31, 1999 and 1998, were 5.9 percent and 5.7 percent,

respectively. The weighted-average interest rates for short-term

loans at December 31, 1999 and 1998, were 4.0 percent and

5.3 percent, respectively.

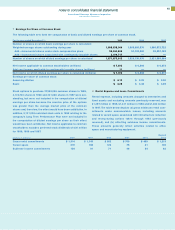

Long-term debt

(Dollars in millions)

At December 31: Maturities 1999 1998

U.S. Dollars:

Debentures:

6.22% 2027 $««««««500 $««««««500

6.5% 2028 700 700

7.0% 2025 600 600

7.0% 2045 150 150

7.125% 2096 850 850

7.5% 2013 550 550

8.375% 2019 750 750

Notes: 6.3% average 2000-2014 4,191 2,695

Medium-term note

program: 5.8% average 2000-2014 6,230 4,885

Other: 6.5% average 2000-2012 1,227 1,514

15,748 13,194

Other currencies

(average interest rate

at December 31, 1999,

in parentheses):

Japanese yen (3.0%) 2000-2014 3,141 3,866

Canadian dollars (5.7%) 2000-2005 707 672

German marks (4.9%) 2002 103 120

Swiss francs (2.5%) 2001 78 91

U.K. pounds (7.0%) 2000-2003 33 25

Other (13.6%) 2000-2014 159 221

19,969 18,189

Less: Net unamortized

discount 40 31

19,929 18,158

Less: Current maturities 5,805 2,650

Total $«14,124 $«15,508

Annual maturities in millions of dollars on long-term debt out-

standing at December 31, 1999, are as follows: 2000, $5,805;

2001, $2,915; 2002, $2,659; 2003, $1,234; 2004, $489; 2005 and

beyond, $6,867.