IBM 1999 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

86

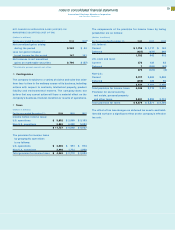

W Retirement Plans

The company and its subsidiaries have defined benefit and defined contribution retirement plans that cover substantially all regular

employees, and a supplemental retirement plan that covers certain executives.

The changes in the benefit obligations and plan assets of the U.S. and material non-U.S. defined benefit plans for 1999 and 1998

were as follows:

U.S. Plan Non-U.S. Plans

(Dollars in millions) 1999 1998 1999 1998

Change in benefit obligation:

Benefit obligation at beginning of year $«36,561 $«33,161 $«22,048 $«18,846

Service cost 566 532 475 399

Interest cost 2,404 2,261 1,282 1,213

Plan participants’ contributions ——29 29

Acquisitions/ divestitures, net 68 22 (47) —

Amendments 75 ——2

Actuarial (gains) losses (2,766) 2,729 522 1,331

Benefits paid from trust (2,474) (2,144) (737) (683)

Direct benefit payments ——(257) (254)

Foreign exchange impact ——(1,552) 1,155

Plan curtailments/ settlements/ termination benefits ——710

Benefit obligation at end of year 34,434 36,561 21,770 22,048

Change in plan assets:

Fair value of plan assets at beginning of year 41,593 38,475 25,294 21,841

Actual return on plan assets 6,397 5,240 5,184 2,400

Employer contribution ——143 452

Acquisitions/ divestitures, net 68 22 (36) —

Plan participants’ contributions ——29 29

Benefits paid from trust (2,474) (2,144) (737) (683)

Foreign exchange impact ——(1,995) 1,283

Settlements ——(39) (28)

Fair value of plan assets at end of year 45,584 41,593 27,843 25,294

Fair value of plan assets in excess of

benefit obligation 11,150 5,032 6,073 3,246

Unrecognized net actuarial gains (7,003) (1,289) (4,597) (2,342)

Unrecognized prior service costs 269 174 140 181

Unrecognized net transition asset (632) (771) (72) (78)

Adjustment to recognize minimum liability ——(84) (87)

Net prepaid pension asset recognized in the

Consolidated Statement of Financial Position $«««3,784 $«««3,146 $«««1,460 $««««««920