IBM 1999 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

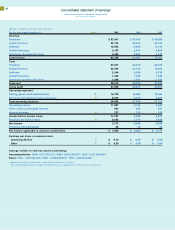

Global Financing

(Dollars in millions) 1999 1998 1997

Revenue $«3,137 $«2,877 $«2,806

Cost 1,446 1,494 1,448

Gross profit $«1,691 $«1,383 $«1,358

Gross profit margin 53.9% 48.1% 48.4%

Global Financing revenue increased 9.0 percent in 1999 from

1998, following an increase of 2.5 percent in 1998 versus 1997.

Growth in working capital financing, along with continued

growth in financing of software and services, drove the revenue

increase in 1999. Financing originations increased to approxi-

mately $43 billion, with year-to-year growth in working capital

financing, along with software and services financing. The reve-

nue increase in 1998 over 1997 was due to improved sales of

used equipment and growth in software and services financing,

offset by a decline in working capital financing.

Gross profit dollars increased 22.3 percent in 1999 versus 1998,

following an increase of 1.8 percent in 1998 over 1997. The

increase in 1999 reflects Global Financing’s ongoing strategy to

increase its use of the company’s Global Treasury Centers

rather than external banks as a funding source and lower costs

of borrowing. The increase in gross profit dollars in 1998 versus

1997 was primarily due to increased revenue and a higher gross

profit margin in the U.S. markets.

Enterprise Investments/ Other

(Dollars in millions) 1999 1998 1997

Revenue $«2,536 $«2,592 $«2,742

Cost 1,558 1,702 1,729

Gross profit $««««978 $««««890 $«1,013

Gross profit margin 38.6% 34.3% 36.9%

Enterprise Investments/ Other revenue decreased 2.2 percent

from 1998, following a decrease of 5.5 percent in 1998 from 1997.

The decrease was driven by lower revenue from discontin-

ued product lines, such as automated teller machines (ATMs),

partially offset by growth in point-of-sale terminals and computer-

aided three-dimensional interactive application (CATIA) software.

The decrease in 1998 versus 1997 was primarily a result of lower

software revenue, partially offset by higher revenue from point-

of-sale terminals.

The gross profit dollars from Enterprise Investments/ Other

increased 9.9 percent in 1999 versus 1998, following a decrease

of 12.1 percent in 1998 versus 1997. The increase in 1999 gross

profit dollars and gross profit margin was primarily driven by an

improving gross profit margin for point-of-sale terminals and

software. The decline in 1998 gross profit dollars and gross

profit margin was primarily driven by the lower software reve-

nue versus 1997.

Operating Expenses

(Dollars in millions) 1999 1998 1997

Selling, general and

administrative $«14,729 $«16,662 $«16,634

Percentage of revenue 16.8% 20.4% 21.2%

Research, development

and engineering $«««5,273 $«««5,046 $«««4,877

Percentage of revenue 6.0% 6.2% 6.2%

Selling, general and administrative (SG&A) expense declined

11.6 percent in 1999 versus 1998 and was essentially flat in

1998 with 1997. The decrease in 1999 reflects the net pre-tax

benefit associated with the sale of the Global Network and the

actions taken by the company in 1999 to improve its competi-

tiveness and to strengthen further the company’s overall business

portfolio. (See note D, “Acquisitions/ Divestitures,” on pages 72

and 73, and note R, “1999 Actions,” on pages 81 and 82 for fur-

ther information.)

The company continues to manage aggressively its infrastructure

expense and its overall portfolio to allow for investment in growth

areas of the business. Key ongoing investments include soft-

ware marketing, major marketing campaigns, and new offerings

for small and medium business opportunities, as well as the

e-business campaign. These types of expenditures are consis-

tent with the company’s ongoing objective of growing revenue

while improving the expense-to-revenue ratio over time.

Research, development and engineering expense increased

4.5 percent in 1999 from 1998, following an increase of 3.5 per-

cent in 1998 from 1997. The increase in 1999 reflects additional

expenses associated with the acquisition of Sequent Computer

Systems, Inc., Mylex Corporation and DASCOM, Inc. Those

acquisitions are intended to improve the company’s long-term

56