IBM 1999 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

54

Server revenue declined 17.9 percent in 1999 from 1998, following

a decrease of 5.9 percent in 1998 versus 1997. S/ 390 revenue

declined in 1999 as customers completed the task of making

Y2Kready the mainframe computers that they use in data

centers to run mission critical, highly integrated enterprise-

wide applications with large transaction volumes. Once the

systems were Y2Ktested and ready, customers were not

inclined to enhance them because of concerns about affecting

their Y2Kreadiness. AS/ 400 revenue declined due to a slow-

down in sales related to Enterprise Resource Planning (ERP)

solutions because of Y2Kconcerns. RS/ 6000 revenue declined

for SP-2 and entry models, partially offset by the enterprise

servers which had strong revenue growth in 1999.

Lower revenue from

S

/ 390,

AS

/ 400 and

RS

/ 6000 drove the

5.9 percent decrease in revenue in

19

98 versus

19

97. While

S

/ 390 revenue declined, total delivery of computing power

increased more than 60 percent as measured in

MIPS

(millions of instructions per second) versus

19

97. Product

transitions late in

19

98 affected the revenue for

AS

/ 400 and

RS

/ 6000 in

19

98 versus

19

97.

In January 2000, the Server Group reorganized to become the

Enterprise Systems Group and adopted a market-centric

alignment to help customers connect and integrate S/ 390,

AS/ 400, RS/ 6000, NUMA-Q and Netfinity servers to support a

wider variety of applications. The reorganized group will focus

on cross-server customer requirements for Web servers,

enterprise servers, mid-market servers, and for storage sub-

systems across all computing environments.

During the year, the company signed major technology contracts

with Dell Computer Corporation (for the purchase of personal

computer parts from the company over seven years), Acer

Incorporated (technology purchase contract over seven years),

EMC Corporation (five-year strategic technology and business

alliance), Cisco Systems, Inc. (technology purchase over five

years) and Nintendo Company, Ltd. (multi-year contract to pur-

chase technology). The total of these contracts could be in

excess of $15 billion.

Hardware gross profit dollars decreased 11.0 percent in 1999

from 1998, following a 14.8 percent decrease in 1998 versus

1997. In 1999, the shift in the company’s revenue away from

servers, pricing pressures associated with HDDs and memory

chip prices drove the declines in gross profit dollars from 1998.

A lower model mix in the mobile HDDs (in which some cus-

tomers are meeting their capacity needs with new mid-range

products, rather than with the more profitable high-end mobile

products) also had a negative effect on gross profit dollars. The

decline in gross profit dollars in 1998 was primarily driven by

lower margins associated with significant price reductions in

Personal Systems products.

Hardware gross profit margin decreases in 1999 versus 1998

and 1998 versus 1997 continued to be driven by the shift in the

company’s revenue away from servers to lower gross profit

products, such as personal computers, OEM chip technology

and HDDs, as well as price pressures.

Global Services

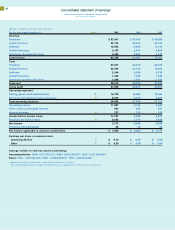

(Dollars in millions) 1999 1998 1997

Revenue $«32,172 $«28,916 $«25,166

Cost 23,304 21,125 18,464

Gross profit $«««8,868 $«««7,791 $«««6,702

Gross profit margin 27.6% 26.9% 26.6%

Global Services revenue increased 11.3 percent in 1999 from

1998 and 14.9 percent in 1998 over 1997. Revenue growth in

1999 without the effect of the sale of the company’s Global

Network to AT&Twould have been 13 percent. (See note D,

“Acquisitions/ Divestitures,” on pages 72 and 73 for additional

information about this sale.)

While maintenance revenues declined 1 percent, reflecting

con

tinued price pressures as customers transitioned to new

technologies, services rev

enue excluding maintenance and the

effect of the sale of the Global Network grew 17 percent.

Strategic Outsourcing Services was a major contributor to this

performance. Strategic Outsourcing Services creates business

value through long-term strategic partnerships with customers

by taking on responsibility for their processes and systems.

Business Innovation Services (formerly Systems Integration

and Consulting) and Integrated Technology Services (formerly

Product Support Services) performance was strong through the

first nine months of 1999 but slowed in the fourth quarter due

to the effect of Y2K-related customer lockdowns and a slow-

down in Y2Kservices.