IBM 1999 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

competitiveness in the server, storage and Web-security

markets, respectively. (See note D, “Acquisitions/ Divestitures,”

on pages 72 and 73 for further detail about the in-process

research and development charge.) In addition, the increases in

both 1999 and 1998 reflect the company’s continued invest-

ments in high-growth opportunities like e-business, Tivoli

systems management and Lotus products, as well as the effect

of ongoing research, development and engineering expense

associated with new acquisitions.

As a result of its ongoing research and development efforts, the

company received 2,756 patents in 1999, placing it number one

in patents granted in the U.S. for the seventh consecutive year.

The application of these technological advances transforms the

company’s research and development into new products.

Examples of these efforts range from new e-business solutions

to innovative manufacturing techniques. A patent for performing

computer-based online commerce using an intelligent agent

will play a major role in future e-business. This patent enables

customers to use intelligent software agents to negotiate for

services from multiple providers. The intelligent agents take

into account both the availability of the requested service, such

as airline seats, and the providers’ business policies, such as

those on cancellations. The agents commit to services with the

most flexible policies first, giving the user the greatest possible

protection. With respect to manufacturing technologies, the

silicon-on-insulator (SOI) chip technology can reduce power

consumption and improve chip performance. A new patent in

1999 defines processing improvements that increase the effi-

ciency and reduce the cost of manufacturing SOI chips. This

technology will be crucial in the industry’s development of a

new class of “pervasive computing” devices, handheld and

embedded products such as smart phones, and Internet appli-

ances that business professionals and consumers will rely on

for easy access to e-business data and services.

See note Y, “Segment Information,” on pages 89 through 93 for

additional information about the pre-tax income of each seg-

ment, as well as the methodologies employed by the company

to allocate shared expenses to the segments.

Provision for Income Taxes

The provision for income taxes resulted in an effective tax rate

of 34.4 percent for 1999, compared with the 1998 effective tax

rate of 30.0 percent and a 1997 effective tax rate of 32.5 percent.

The 4.4 point increase from the 1998 rate is the result of the

company’s sale of its Global Network business to AT&Tand

various other actions implemented during 1999. (See note D,

“Acquisitions/ Divestitures,” on pages 72 and 73 and note R,

“1999 Actions,” on pages 81 and 82 for further detail regarding

the tax impacts of these items.) The reduction in the 1998 tax

rate versus 1997 reflects the company’s continued expansion

into markets with lower effective tax rates.

The company accounts for income taxes under Statement of

Financial Accounting Standards (SFAS) No. 109, “Accounting

for Income Taxes,” which provides that a valuation allowance

should be recognized to reduce the deferred tax asset to the

amount that is more likely than not to be realized. In assessing

the likelihood of realization, management considered estimates

of future taxable income.

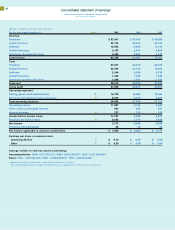

Fourth Quarter

For the quarter ended December 31, 1999, the company had

revenue of $24.2 billion, a decrease of 3.8 percent from the same

period in 1998. Net income in the fourth quarter was $2.1 billion

($1.12 per diluted common share), compared with net income

of $2.3 billion ($1.24 per diluted common share) in the fourth

quarter of 1998.

Revenue for the fourth quarter of 1999 from the company’s

end-user businesses totaled $10.4 billion from the Americas, a

decrease of 3.7 percent (2 percent decrease in constant cur-

rency) compared with the same period last year. Revenue from

Europe/ Middle East/ Africa was $7.2 billion, down 15.0 percent

(6 percent decrease in constant currency). Asia Pacific revenue

grew 12.3 percent (2 percent increase in constant currency) to

$4.4 billion. OEM revenue across all geographies was $2.2 bil-

lion, a 12.5 percent increase (12 percent in constant currency)

compared with the fourth quarter of 1998.

57