IBM 1999 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

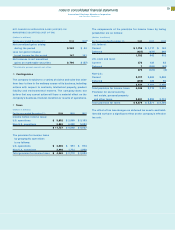

NET CHANGE IN UNREALIZED GAINS (LOSSES) ON

MARKETABLE SECURITIES (NET OF TAX)

(Dollars in millions)

For the year ended December 31: 1999 1998**

Net unrealized gains arising

during the period $«943 $÷44

Less net gains included

in net income for the period 147 101

Net increase in net unrealized

gains on marketable securities $«796 $«(57)

*Restated to present amounts net of tax.

O Contingencies

The company is subject to a variety of claims and suits that arise

from time to time in the ordinary course of its business, including

actions with respect to contracts, intellectual property, product

liability and environmental matters. The company does not

believe that any current action will have a material effect on the

company’s business, financial condition or results of operations.

P Taxes

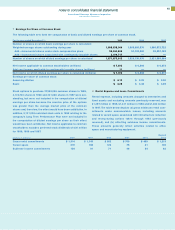

(Dollars in millions)

For the year ended December 31: 1999 1998 1997

Income before income taxes:

U.S. operations $«««5,892 $«2,960 $«3,193

Non-U.S. operations 5,865 6,080 5,834

$«11,757 $«9,040 $«9,027

The provision for income taxes

by geographic operations

is as follows:

U.S. operations «$«««2,005 $««««991 $««««974

Non-U.S. operations 2,040 1,721 1,960

Total provision for income taxes $«««4,045 $«2,712 $«2,934

The components of the provision for income taxes by taxing

jurisdiction are as follows:

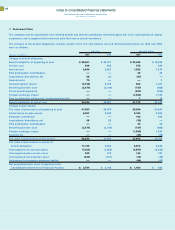

(Dollars in millions)

For the year ended December 31: 1999 1998 1997

U.S. federal:

Current $«1,759 $«1,117 $««««163

Deferred (427) (475) 349

1,332 642 512

U.S. state and local:

Current 272 139 83

Deferred 7(260) (87)

279 (121) (4)

Non-U.S.:

Current 2,727 2,062 2,330

Deferred (293) 129 96

2,434 2,191 2,426

Total provision for income taxes 4,045 2,712 2,934

Provision for social security,

real estate, personal property

and other taxes 2,831 2,859 2,774

Total provision for taxes $«6,876 $«5,571 $«5,708

The effect of tax law changes on deferred tax assets and liabil-

ities did not have a significant effect on the company’s effective

tax rate.

79