IBM 1999 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

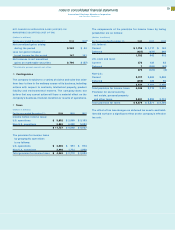

Net periodic pension cost is determined using the Projected

Unit Credit actuarial method.

The effects on the company’s results of operations and financial

position from most changes in the estimates and assumptions

used to compute pension and prepaid pension assets or pen-

sion liability is mitigated by the delayed recognition provisions

of SFAS No. 87, “Employers’ Accounting for Pensions.” The effects

of settlement gains, curtailment losses and early terminations

are recognized immediately. The 1.25 percent increase in the

discount rate in 1999 resulted in an actuarial gain of $5,003 mil-

lion for the U.S. plan. The 0.5 percent decrease in the discount

rate in 1998 resulted in an actuarial loss of $2,144 million for

the U.S. plan.

It is the company’s practice to fund amounts for pensions

sufficient to meet the minimum requirements set forth in appli-

cable employee benefits laws and local tax laws. From time to

time, the company contributes additional amounts as it deems

appropriate. Liabilities for amounts in excess of these funding

levels are accrued and reported in the company’s Consolidated

Statement of Financial Position. The assets of the various plans

include corporate equities, government securities, corporate

debt securities and real estate.

At December 31, 1999, the material non-U.S. defined benefit plans

in which the plan assets exceeded the benefit obligation had

obligations of $21,168 million and assets of $27,400 million.

The material non-U.S. defined benefit plans in which the benefit

obligation exceeded the fair value of plan assets had obligations

of $602 million and assets of $443 million.

At December 31, 1998, the material non-U.S. defined benefit plans

in which the plan assets exceeded the benefit obligation had

obligations of $18,217 million and assets of $21,736 million.

The material non-U.S. defined benefit plans in which the benefit

obligation exceeded the fair value of plan assets had obligations

of $3,831 million and assets of $3,558 million.

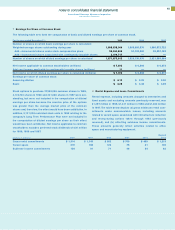

X Nonpension Postretirement Benefits

The company and its U.S. subsidiaries have defined benefit

postretirement plans that provide medical, dental and life insur-

ance for retirees and eligible dependents. Effective July 1, 1999,

IBM established a “Future Health Account (FHA) Plan” for

employees who are more than five years away from retirement

eligibility. Employees who are eligible to retire within five years

retained the benefits under the company’s preexisting retiree

health benefits plan. Under either the FHA or the preexisting

plan, there is a maximum cost to the company for retiree health

care. For employees who retired before January 1, 1992, that

maximum will become effective in the year 2001. For all other

employees, the maximum is effective on retirement.

The changes in the benefit obligation and plan assets of the

U.S. plans for 1999 and 1998 are as follows:

(Dollars in millions) 1999 1998

Change in benefit obligation:

Benefit obligation at beginning of year $««6,457 $««6,384

Service cost 48 42

Interest cost 424 427

Amendments (127) (26)

Actuarial gains (445) (146)

Actuarial losses 371 272

Benefits paid from trust (325) (486)

Direct benefit payments (225) (10)

Benefit obligation at end of year 6,178 6,457

Change in plan assets:

Fair value of plan assets at

beginning of year 123 120

Actual (loss)/ gain on plan assets (18) 10

Employer contributions 325 479

Benefits paid, net of employee

contributions (325) (486)

Fair value of plan assets at end of year 105 123

Benefit obligation in excess

of plan assets (6,073) (6,334)

Unrecognized net actuarial losses 631 700

Unrecognized prior service costs (948) (965)

Accrued postretirement benefit

liability recognized in the

Consolidated Statement

of Financial Position $«(6,390) $«(6,599)

88