IBM 1999 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

76

The company enters into contracts that effectively provide the

company with committed future borrowings in select foreign

currencies. The aggregate notional value of these contracts

was $6.4 billion and $3.0 billion as of December 31, 1999 and

1998, respectively. The terms of these contracts generally are

less than eighteen months. Foreign exchange gains and losses

associated with these contracts are recorded in net income as

they are realized. These amounts have not been and are not

expected to be material to the company’s financial results.

Derivative Financial Instruments

The company uses derivative financial instruments as an element

of its risk management strategy. The company manages the risk

A significant portion of the company’s derivative transactions

relates to matching the interest and foreign currency rate pro-

files of funding liabilities with the interest and foreign currency

rate profiles of global financing and other market risk sensitive

assets. The company issues debt, using the most efficient cap-

ital markets and products, which may result in a currency or

interest rate mismatch with the underlying assets. The company

uses interest rate swaps or currency swaps to match the interest

rate and currency profiles of its debt to the related assets. The

terms of these swap contracts generally are less than five

years. Net interest settlements and currency rate differentials

that accrue under interest rate and currency swap contracts,

respectively, are recognized in interest expense over the life of

the contracts.

The company uses its Global Treasury Centers to manage the

cash of its subsidiaries. These treasury centers principally use

currency swaps to convert cash flows in a cost-effective manner,

predominantly for the company’s European subsidiaries. The

terms of the swaps generally are less than one year. The interest

rate differential in these contracts is recognized in interest

expense over the life of the contracts.

The company also uses currency swaps and other foreign

currency contracts to hedge the foreign currency exposures of

certain of the company’s net investments in foreign subsidiaries.

The currency effects of these hedges are reflected in the

Accumulated gains and losses not affecting retained earnings

section of stockholders’ equity thereby offsetting a portion of

the translation of the net foreign assets.

of nonperformance by counterparties by establishing explicit

dollar and term limitations that correspond to the credit rating

of each carefully selected counterparty. The company has not

sustained a material loss from these instruments nor does it

anticipate any material adverse effect on its results of opera-

tions or financial position in the future.

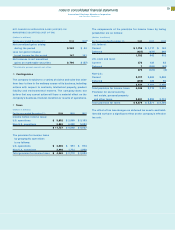

The following table summarizes the notional value, carrying value

and fair value of the company’s derivative financial instruments

on- and off-balance sheet. The notional value at December 31

provides an indication of the extent of the company’s involvement

in these instruments at that time, but does not represent exposure

to credit, interest rate or foreign exchange rate market risks.

At December 31, 1999 At December 31, 1998

Notional Carrying Fair Notional Carrying Fair

(Dollars in millions) Value Value Value Value Value Value

Interest rate and currency contracts $«29,830 $«(257) $«(491) $«31,484 $«(485) $«(427)

Option contracts 1,705 59 54 9,021 67 45

Total $«31,535 $«(198) $«(437) * $«40,505 $«(418) $«(382) *

Amounts in parentheses are liabilities.

*The estimated fair value of derivatives both on- and off-balance sheet at December 31, 1999 and 1998, comprises assets of $616 million and $486 million

and liabilities of $1,053 million and $868 million, respectively.