IBM 1999 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

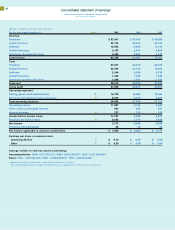

Hardware revenue declined 10.7 percent (10 percent in constant

currency) to $10.2 billion from the 1998 fourth quarter. Y2K-

related declines in customer demand were a significant factor

behind fourth-quarter revenue decreases in S/ 390, AS/ 400,

RS/ 6000 and personal computers. However, within the

company’s

server family, Netfinity

PC

revenues increased significantly, as did

revenues from

RS

/ 6000 mid-range servers, including the advanced

RS

/ 6000 Model S80. Microelectronics

revenues increased sub-

stantially, principally due to growth in custom logic shipments.

Shipments of the company’s new “Shark” disk storage product

were strong in the quarter, although overall storage revenues

declined largely as a result of ongoing price pressures in HDDs.

The overall hardware gross profit margin declined to 26.6 percent

from 34.2 percent.

Global Services revenue grew 2.0 percent (4 percent in constant

currency) versus the fourth quarter of 1998. Strategic Outsourc-

ing showed good growth versus the fourth quarter of 1998.

Networking Services declined year to year due to the sale of the

Global Network to AT&Tduring 1999, while revenue from the

other categories of services was flat or declined as a result of

the Y2K-related slowdown. The company’s services unit signed

more than $10 billion in services contracts in the quarter.

Revenue from maintenance offerings was essentially flat when

compared with the fourth quarter of 1998.

Software revenue totaled $3.6 billion, up 1.7 percent (6 percent

in constant currency) over the prior year’s final quarter.

Middleware—which is critical for e-business—grew 8 percent

(13 percent at constant currency), with record fourth quarter

shipments of Lotus Notes and Domino groupware products and

strong performance in database, transaction processing, and

Tivoli system management software. The software gross profit

margin improved 1.1 points year over year to 83.4 percent.

Global Financing revenue increased 19.3 percent (22 percent

in constant currency) versus the same period of 1998, and

Enterprise Investments/ Other declined 13.3 percent (10 percent

in constant currency) compared with 1998’s fourth quarter. The

revenue decline in Enterprise Investments/ Other resulted from

the company’s strategy to withdraw from certain businesses,

such as ATMs.

The company’s overall gross profit margin in the fourth quarter

was 36.7 percent, compared with 39.0 percent in the year-earlier

period. The decrease was primarily due to a drop in the hard-

ware margin of 7.6 points from the fourth quarter 1998 across

S/ 390 and AS/ 400 servers, storage and personal computer

products. This decrease was partially offset by improved margins

for services and software in the fourth quarter of 1999 versus

the same period in 1998.

Total fourth-quarter 1999 expense declined 9.3 percent when

compared with the fourth quarter of 1998. The decline reflects

lower revenue-related expenses due to the slowdown that is

included in the fourth quarter results. The quarter also reflected

expenses associated with infrastructure reductions in areas

such as Sales and Distribution,

Personal Systems and Server

Group, which offset a gain associated with the sale to Cisco

Systems, Inc. of certain IBM intellectual property. The expense-

to-revenue ratio in the fourth quarter of

19

99 was

24.4 percent,

compared with 25.9 percent in the year-earlier period.

The company’s tax rate was 30.0 percent in the fourth quarter,

compared with 28.9 percent in the fourth quarter of 1998.

The company spent approximately $2.1 billion on common share

repurchases in the fourth quarter. The average number of shares

outstanding in the fourth quarter of 1999 was 1,793.0 million,

compared with 1,839.5 million in the year-earlier period. The aver-

age number of shares outstanding for purposes of calculating

diluted earnings per share was 1,847.8 million in the fourth quar-

ter of 1999 versus 1,894.3 million in the fourth quarter of 1998.

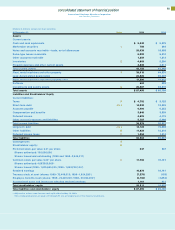

Financial Condition

During 1999, the company continued to make significant

investments to fund future growth and increase shareholder

value, spending $5,806 million for research, development and

engineering; $4,346 million for plant and other property, including

machines used in strategic outsourcing contracts; $1,613 million

for machines on operating leases with customers; $1,542 million

for strategic acquisitions; and $7,280 million for the repurchase

of the company’s common shares. The company had $5,831 mil-

lion in cash and cash equivalents and marketable securities at

December 31, 1999.

The company has access to global funding sources. During

1999, the company issued debt in a variety of geographies to a

diverse set of investors, including significant funding in the

United States, Japan and Europe. The funding has a wide range

of maturities from short-term commercial paper to long-term

debt. More information about company debt is provided in

note J, “Debt,” on page 74.

58