IBM 1999 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

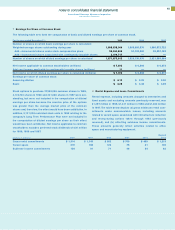

In January 1998, the company acquired Software Artistry, Inc., a

leading provider of both consolidated service desk and cus-

tomer relationship management solutions for distributed

enterprise environments. In March 1998, the company acquired

CommQuest Technologies, Inc., a company that designs and

markets advanced semiconductors for wireless communications

applications such as cellular phones and satellite communica-

tions. In connection with these acquisitions, the company

recorded a pre-tax charge for IPR&Dof $111 million ($111 mil-

lion after tax, or $.06 per diluted common share).

On April 16, 1997, the company purchased a majority interest in

NetObjects, a leading provider of Web site development tools

for designers and intranet developers. In 1999, as a result of

NetObject’s initial public offering, the company’s interest

declined to less than 50 percent. In September 1997, the com-

pany acquired the 30 percent equity interest held by Sears in

Advantis, the U.S. network services arm of the company’s

Global Network. Advantis was then owned 100 percent by the

company. Advantis became part of the company’s Global

Network, which the company sold to AT&Tin 1999. In December

1997, the company acquired Eastman Kodak’s share of

Technology Service Solutions, which was formed in 1994 by the

company and Eastman Kodak. In December 1997, the company

acquired Unison Software, Inc., a leading developer of workload

management software. In connection with these acquisitions

the company recorded a pre-tax charge for IPR&Dof $111 mil-

lion ($111 million after tax, or $.05 per diluted common share).

Divestitures

In December 1998, the company announced that it would sell

its Global Network business to AT&T. During 1999, the company

completed the sale to AT&Tfor $4,991 million. More than 5,300

IBM employees joined AT&Tas a result of these sales of oper-

ations in 71 countries.

The company recognized a pre-tax gain of $4,057 million

($2,495 million after tax, or $1.33 per diluted common share).

The net gain reflects dispositions of Plant, rental machines and

other property of $410 million, other assets of $182 million and

contractual obligations of $342 million.

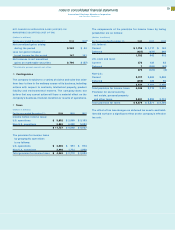

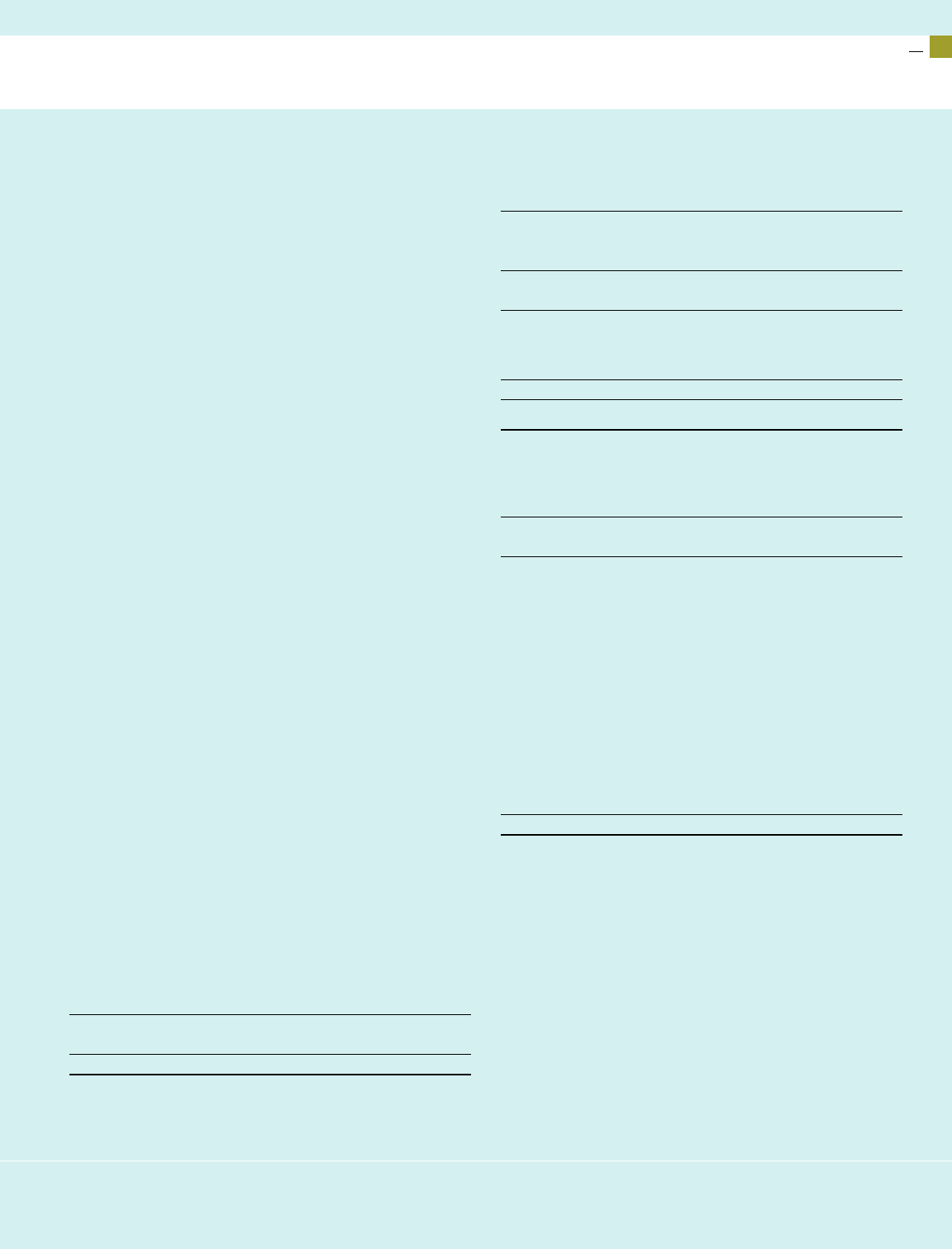

E Inventories

(Dollars in millions)

At December 31: 1999 1998

Finished goods $«1,162 $«1,088

Work in process and raw materials 3,706 4,112

Total $«4,868 $«5,200

F Plant, Rental Machines and Other Property

(Dollars in millions)

At December 31: 1999 1998

Land and land improvements $«««1,026 $«««1,091

Buildings 10,395 11,088

Plant, laboratory and office equipment 22,503 27,025

33,924 39,204

Less: Accumulated depreciation 19,268 22,463

14,656 16,741

Rental machines 5,692 5,666

Less: Accumulated depreciation 2,758 2,776

2,934 2,890

Total $«17,590 $«19,631

G Investments and Sundry Assets

(Dollars in millions)

At December 31: 1999 1998

Net investment in sales-type leases*$«14,201 $«14,384

Less: Current portion—net 6,220 6,510

7,981 7,874

Deferred taxes 2,654 2,921

Prepaid pension assets 5,636 4,836

Customer loan receivables—

not yet due 4,219 3,499

Installment payment receivables 848 1,087

Alliance investments:

Equity method 595 420

Other—available for sale 1,439 138

Goodwill, less accumulated amortization

(1999, $2,646; 1998, $2,111) 1,045 945

Marketable securities—non-current 113 281

Other investments and sundry assets 1,557 1,509

Total $«26,087 $«23,510

*These leases relate principally to IBM equipment and are generally for

terms ranging from three to five years. Net investment in sales-type leases

includes unguaranteed residual values of approximately $737 million and

$685 million at December 31, 1999 and 1998, respectively, and is reflected

net of unearned income at those dates of approximately $1,600 million for

both years. Scheduled maturities of minimum lease payments outstanding

at December 31, 1999, expressed as a percentage of the total, are approxi-

mately as follows: 2000, 49 percent; 2001, 32 percent; 2002, 14 percent;

2003, 4 percent; and 2004 and beyond, 1 percent.

73