IBM 1999 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 1999 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

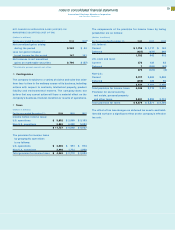

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

Goodwill

Goodwill is charged to net income on a straight-line basis over the

periods estimated to benefit, generally not to exceed five years.

The company performs reviews to evaluate the recoverability of

goodwill and takes into account events or circumstances that

warrant revised estimates of useful lives or that indicate that an

impairment exists.

Common Stock

Common stock refers to the $.20 par value capital stock as

designated in the company’s Certificate of Incorporation.

Earnings Per Share of Common Stock

Earnings per share of common stock—basic is computed by

dividing Net income applicable to common stockholders by the

weighted-average number of common shares outstanding for

the period. Earnings per share of common stock—assuming

dilution reflects the maximum potential dilution that could occur

if securities or other contracts to issue common stock were

exercised or converted into common stock and would then

share in the net income of the company. See note T, “Earnings

Per Share of Common Stock,” on page 83 for further discussion.

B Accounting Changes

Standards Implemented

The company implemented new accounting standards in 1999,

1998 and 1997. None of these standards had a material effect on

the financial position or results of operations of the company.

Effective January 1, 1999, the company adopted American

Institute of Certified Public Accountants (AICPA) Statement of

Position (SOP) 98-1, “Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use.” The SOP

requires a company to capitalize certain costs that are incurred

to purchase or to create and implement internal use computer

software. See note A, “Significant Accounting Policies” on pages

69 through 71 for a description of the company’s policies for

internal use software.

Effective December 31, 1998, the company adopted SFAS No. 131,

“Disclosures about Segments of an Enterprise and Related

Information,” which establishes standards for reporting operat-

ing segments and disclosures about products and services,

geographic areas and major customers. See note Y, “Segment

Information,” on pages 89 through 93 for the company’s seg-

ment information.

Effective December 31, 1998, the company adopted SFAS No. 132,

“Employers’ Disclosures about Pensions and Other Postretire-

ment Benefits,” which establishes standardized disclosures for

defined benefit pension and postretirement benefit plans. See

note W, “Retirement Plans,” on pages 86 through 88 and note X,

“Nonpension Postretirement Benefits,” on pages 88 and 89 for

the disclosures.

Effective January 1, 1998, the company adopted SFAS No. 130,

“Reporting Comprehensive Income,” which establishes standards

for reporting and displaying in a full set of general-purpose

financial statements the gains and losses not affecting retained

earnings. The disclosures required by SFAS No. 130 are pre-

sented in the Accumulated gains and losses not affecting

retained earnings section in the Consolidated Statement of

Stockholders’ Equity on pages 66 and 67 and in note N, “Stock-

holders’ Equity Activity,” on pages 78 and 79.

Effective January 1, 1998, the company adopted the AICPA

SOP 97-2, “Software Revenue Recognition.” This SOP provides

guidance on revenue recognition for software transactions.

See note A, “Significant Accounting Policies” on pages 69

through 71 for a description of the company’s policy for software

revenue recognition.

Effective December 31, 1997, the company implemented SFAS

No. 128, “Earnings Per Share” (EPS). This statement prescribes

the methods for calculating basic and diluted EPS and

requires dual presentation of these amounts on the face of the

Consolidated Statement of Earnings.

Effective January 1, 1997, the company implemented SFAS No. 125,

“Accounting for Transfers and Servicing of Financial Assets

and Extinguishments of Liabilities.” This statement provides

accounting and reporting standards for transfers and servicing

of financial assets and extinguishments of liabilities.

New Standards to be Implemented

In June 1999, the Financial Accounting Standards Board issued

SFAS No. 137, “Accounting for Derivative Instruments and

Hedging Activities—Deferral of the Effective Date of FAS B

Statement No. 133.” This statement defers the effective date of

SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” to fiscal years beginning after June 15,

2000, although early adoption is encouraged. SFAS No. 133

establishes accounting and reporting standards for derivative

instruments. It requires a company to recognize all derivatives as

71