Haier 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

2.3 Impact of Issued But Not Yet Effective

Hong Kong Financial Reporting Standards

(Cont’d)

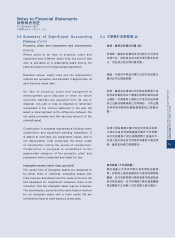

HK(IFRIC)-Int 11 requires arrangements whereby

an employee is granted rights to the Group’s equity

instruments, to be accounted for as an equity-settled

scheme, even if the Group acquires the instruments

from another party, or the shareholders provide the

equity instruments needed. HK(IFRIC)-Int 11 also

addresses the accounting for share-based payment

transactions involving two or more entities within

the Group. As the Group currently has no such

transactions, the interpretation is unlikely to have any

financial impact on the Group.

HK(IFRIC)-Int 12 requires an operator under public-

to-private service concession arrangements to

recognise the consideration received or receivable in

exchange for the construction services as a financial

asset and/or an intangible asset, based on the terms

of the contractual arrangements. HK(IFRIC)-Int 12

also addresses how an operator shall apply existing

HKFRSs to account for the obligations and the rights

arising from service concession arrangements by

which a government or a public sector entity grants

a contract for the construction of infrastructure used

to provide public services and/or for the supply of

public services. As the Group currently has no such

arrangements, the interpretation is unlikely to have

any financial impact on the Group.

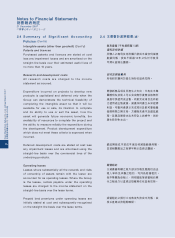

HK(IFRIC)-Int 13 requires that loyalty award credits

granted to customers as part of a sales transaction

are accounted for as a separate component of the

sales transaction. The consideration received in the

sales transaction is allocated between the loyalty

award credits and the other components of the sale.

The amount allocated to the loyalty award credits

is determined by reference to their fair value and is

deferred until the awards are redeemed or the liability

is otherwise extinguished.

2.3 已頒佈但未生效之香港財務報告準

則之影響

(續)

香港(國際財務匯報準則)- 詮釋第 11 號要

求僱員獲授予本集團股本工具之權利安排應

如以股權結算之計劃作會計處理,即使本集

團向另一方獲得工具或股東提供所需之股

本工具。香港(國際財務匯報準則)-詮釋第

11號亦關注到涉及本集團內兩個或以上實

體之以股份支付之交易之會計處理方法。由

於本集團目前並無此類交易,故此詮釋不大

可能會對本集團構成任何財務影響。

香港(國際財務匯報準則)- 詮釋第 12 號要

求在公私營特許服務權安排下之經營者根據

合約安排條款將為換取建築服務而已收或應

收代價確認為金融資產及╱或無形資產。香

港(國際財務匯報準則)- 詮釋第12 號亦關

注經營者如何應用現行香港財務報告準則去

處理就政府或公營機構藉以提供公眾服務及

╱或供應公眾服務而授予與建築基建項目合

約有關之特許服務權安排所引起之責任及權

利。由於本集團目前並無此類安排,故此詮

釋不大可能會對本集團構成任何財務影響。

香港(國際財務匯報準則)- 詮釋第 13 號要

求忠誠獎勵作為銷售業務之一部份授予客戶

應以銷售業務獨立項目作會計處理。銷售業

務收到之代價會分攤到忠誠獎勵及銷售之其

他部份。分攤到忠誠獎勵之金額以其公平值

釐定及遞延直至獎勵贖回或負債終絕為止。