Haier 2007 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

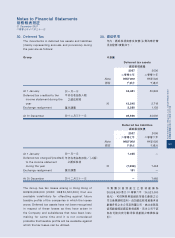

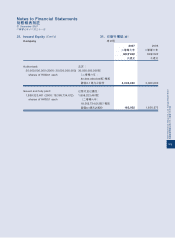

32. Share Option Scheme (Cont’d)

Share options granted to a director, chief executive

or substantial shareholder of the Company, or to

any of their respective associates, are subject to

the approval in advance by the independent non-

executive directors of the Company (and if required,

the independent non-executive directors of the

holding company), excluding the independent non-

executive director(s) of the Company and the holding

company who is/are the grantee(s) of the options. In

addition, any share option granted to a substantial

shareholder or an independent non-executive

director of the Company, or to any of their respective

associates, in excess of 0.1% of the shares of the

Company in issue as at the date of grant or with

an aggregate value (based on the closing price of

the shares of the Company as at the date of grant)

in excess of HK$5 million, within any 12-month

period, is subject to the issue of a circular by the

Company (and if required, the holding company) and

the shareholders’ approval of the Company (and if

required, the approval of the shareholders of the

holding company) in advance at a general meeting.

The offer of a grant of share options may be

accepted within 28 days from the date of the offer,

upon payment of a nominal consideration of HK$1

in total by the grantee. The exercise period of the

share options granted is determinable by the Board,

and commences on a specified date and ends on a

date which is not later than 10 years from the date of

grant of the share options or the expiry date of the

Share Option Scheme, whichever is earlier.

The exercise price of the share options is

determinable by the Board, but may not be less than

the highest of (i) the closing price of the shares of

the Company as stated in the daily quotation sheet

of the Stock Exchange on the date of grant, which

must be a trading day; (ii) the average closing price

of the shares of the Company as stated in the Stock

Exchange’s daily quotation sheets for the five trading

days immediately preceding the date of grant; and

(iii) the nominal value of the shares of the Company.

32. 購股權計劃

(續)

向本公司之董事或最高行政人員或主要股東

或彼等各自之任何聯繫人授出購股權,事先

必須獲得本公司之獨立非執行董事(及(如

有需要)控股公司之獨立非執行董事)批准

(身為購股權承授人之本公司及控股公司獨

立非執行董事除外)。此外,如於任何十二

個月期間向本公司之主要股東或獨立非執行

董事或彼等各自任何聯繫人授出之購股權所

涉之股份,超過授出當日本公司已發行股份

0.1%或總值(根據授出當日本公司股份之

收市價格計算)超過5,000,000 港元,則本

公司(及(如有需要)控股公司)須事先刊發

通函及於股東大會徵求本公司股東(及(如有

需要)控股公司之股東)批准。

授出購股權之建議可於建議日期起計28 日

內由承授人支付象徵式代價合共1 港元後接

納。已授出購股權之行使期由董事會釐定,

由指定之日期開始至授出購股權日期起計不

超過十年之日或購股權計劃期滿日(以較早

者為準)為止。

購股權之行使價由董事會釐定,惟不得低於

下列三者之最高者:(i)本公司股份於授出當

日(必須為交易日)在聯交所每日報價表所列

之收市價;(ii) 本公司股份於緊接授出當日

前五個交易日在聯交所每日報價表所列之平

均收市價;及(iii) 本公司股份之面值。