Haier 2007 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

158

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

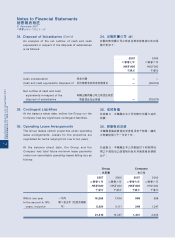

39. Financial Risk Management Objectives

and Policies (Cont’d)

Foreign currency risk

The Group has transactional currency exposures.

Such exposures mainly arise from sales or purchases

by the Group’s operating units operating in Mainland

China in currencies other than the units’ functional

currency (i.e., RMB). The Group does not enter into

any hedging transactions in an effort to reduce the

Group’s exposure to foreign currency risk.

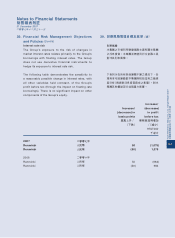

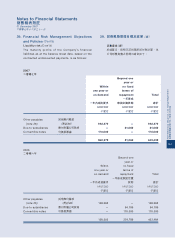

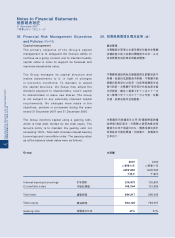

The following table demonstrates the sensitivity at

the balance sheet date to a reasonably possible

change in the exchange of rates of Euro, United

States Dollar and Japanese Yen, with all other

variables held constant, of the Group’s profit before

tax (due to changes in the fair value of monetary

assets and liabilities). There is no significant impact

on other components of the Group’s equity.

Increase/

(decrease) in

exchange rates

Increase/

(decrease)

in profit

before tax

匯率上升

/(下跌)

除稅前溢利增加

/(減少)

%HK$’000

千港元

2007 二零零七年

If Renminbi strengthens against Euro 倘人民幣兌歐羅升值 5(6,569)

If Renminbi strengthens against

United States Dollar

倘人民幣兌美元升值 5(2,384)

If Renminbi strengthens against

Japanese Yen

倘人民幣兌日圓升值 5(538)

If Renminbi weakens against Euro 倘人民幣兌歐羅貶值 (5) 6,569

If Renminbi weakens against United

States Dollar

倘人民幣兌美元貶值 (5) 2,384

If Renminbi weakens against

Japanese Yen

倘人民幣兌日圓貶值 (5) 538

2006 二零零六年

If Renminbi strengthens against Euro 倘人民幣兌歐羅升值 55,385

If Renminbi strengthens against United

States Dollar

倘人民幣兌美元升值 5(1,396)

If Renminbi strengthens against

Japanese Yen

倘人民幣兌日圓升值 5340

If Renminbi weakens against Euro 倘人民幣兌歐羅貶值 (5) (5,385)

If Renminbi weakens against United

States Dollar

倘人民幣兌美元貶值 (5) 1,396

If Renminbi weakens against Japanese

Yen

倘人民幣兌日圓貶值 (5) (340)

39. 財務風險管理目標及政策

(續)

外幣風險

本集團涉及交易貨幣風險。該等風險來自在

中國大陸經營之營運單位以功能貨幣(即人

民幣)以外貨幣進行銷售或購買。本集團並

無進行任何對沖交易以減低本集團之外幣風

險。

下表列示在所有其他變數不變之情況下,歐

羅、美元及日圓之合理匯率可能變動對本集

團除稅前溢利之敏感度分析(由於貨幣資產

及負債之公平值改變)。對本集團其他權益

部分並無重大影響。