Haier 2007 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

159

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

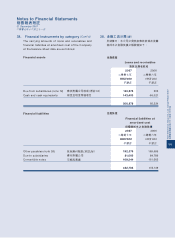

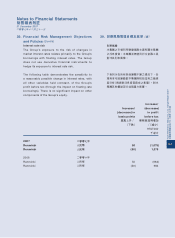

39. Financial Risk Management Objectives

and Policies (Cont’d)

Credit risk

The Group trades only with recognised and

creditworthy third parties. It is the Group’s policy that

all customers who wish to trade on credit terms are

subject to credit verification procedures. In addition,

receivable balances are monitored on an ongoing

basis and the Group’s exposure to bad debts is not

significant.

The credit risk of the Group’s other financial assets,

which comprise cash and cash equivalents and other

receivables, arises from default of the counterparty,

with a maximum exposure equal to the carrying

amounts of these instruments.

Since the Group trades only with recognised and

creditworthy third parties, there is no requirement for

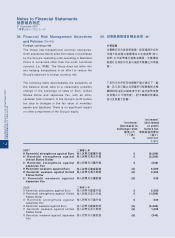

collateral. Concentrations of credit risk are analysed

by customer/counterparty and by geographical

region. At the balance sheet date, the Group has

certain concentrations of credit risk as 94% (2006:

25%) of the Group’s trade receivables were due from

the five largest customers of the Group.

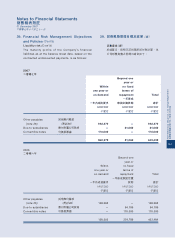

Further quantitative data in respect of the Group’s

exposure to credit risk arising from trade receivables

are disclosed in note 22 to the financial statements.

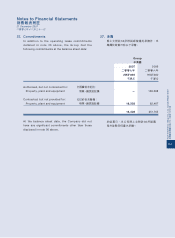

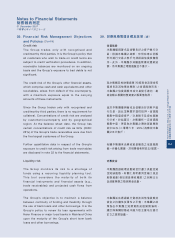

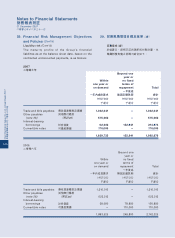

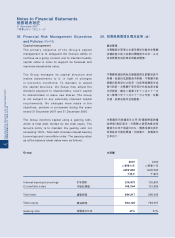

Liquidity risk

The Group monitors its risk to a shortage of

funds using a recurring liquidity planning tool.

This tool considers the maturity of both its

financial instruments and financial assets (e.g.,

trade receivables) and projected cash flows from

operations.

The Group’s objective is to maintain a balance

between continuity of funding and flexibility through

the use of bank loans and other borrowings. It is the

Group’s policy to renew its loan agreements with

Haier Finance or major local banks in Mainland China

upon the maturity of the Group’s short term bank

loans and other borrowings.

39. 財務風險管理目標及政策

(續)

信貸風險

本集團僅與著名及信譽良好之客戶進行交

易。根據本集團之政策,任何有意以記賬

形式進行交易之客戶均須經過信貸核實程

序。此外,本集團亦持續監察應收賬款結

餘,而本集團之壞賬風險並不重大。

就本集團其他財務資產(包括現金及現金等

值項目及其他應收賬款)之信貸風險而言,

本集團之信貸風險來自交易對手違約,最

高金額以相關財務資產之賬面值為限。

由於本集團僅與著名及信譽良好的客戶進

行交易,因此並無要求提供抵押。信貸風

險集中程度按客戶╱交易對手及按地區進

行分析。於結算日,本集團有一定信貸風

險集中度,原因為本集團之應收貿易賬款

其中94%

(二零零六年 ︰

25%)為應收本集

團之五大客戶。

有關本集團來自應收貿易賬款之信貸風險

進一步量化數據,於財務報表附註22 披露。

流動資金

本集團透過椒環流動資金計劃工具監控資

金短缺風險。有關工具考慮其金融工具及

財務資產(例如貿易應收賬款)之到期日以

及經營業務之預測現金流量。

本集團旨在透過銀行貸款及其他借貸維持

資金之持續性及彈性之平衡。本集團之政

策為在本集團之短期貸款或借貸期滿時,

續訂與海爾財務或中國大陸主要地方銀行

訂立之貸款協議。